Roth Conversions, Lucky Hills and Water Backup

Three Months Left for Roth Conversions

December 29th is the last day for Roth IRA conversions for 2023. For those who are under the 24% Federal tax bracket and have at least 5 years before making a withdrawal, we believe a Roth IRA conversion makes sense. A Roth IRA conversion is done by converting portions or all of a Traditional IRA to a Roth IRA. The conversion will trigger a taxable event, but then going forward the money in the new Roth IRA will be forever tax-free for you and your beneficiaries. Additional benefits include:

- No taxation on dividends or capital gains which makes Roth IRAs a powerful retirement income generator.

- Distributions do not count against Social Security taxation.

- There is no point in time when the government requires you to take a withdrawal.

The Lucky Have a Hill

I recently heard someone compare the act of pursuing a goal to climbing a steep mountain. This analogy instantly brought back memories of a hiking trip I took in the Rocky Mountains with a friend. We faced several grueling climbs, especially halfway up the mountain, where each step required sheer willpower (at least for me). True to expectation, the views at the summits were breathtaking and well worth the effort.

Interestingly, when I reminisce about that trip, it's not the panoramic views from the top that stand out the most; rather, it's the journey—the climb. I remember gasping for breath, dealing with altitude sickness, feeling the weight in my legs, grappling with doubts, and yet, pushing for the next step forward.

The real treasure from that trip wasn't the summit but the climb itself. The fortunate ones in this world have a goal that demands a challenging ascent. The very luckiest spend a lifetime mastering or chasing their objectives. It is through such purpose that sustained happiness is discovered. Those who lack a challenging hill to climb, who opt for the path of least resistance, often try to find meaning by cluttering their lives with external things that only offer fleeting moments of joy. If today you gaze up at your personal summit and feel it might be a long journey before you reach it, count yourself among the blessed.

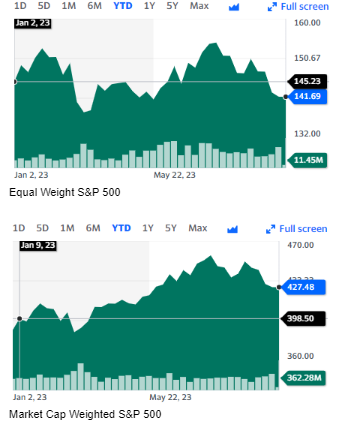

Great divergence between two versions of the S&P 500

The S&P 500 is an index of 503 large cap U.S. stocks that many investors use as a gauge of the U.S. stock market. There are two versions of this index: 1) equal weight and 2) market cap weighted. The equal weight S&P 500 is just as it sounds, each stock is given equal investment weight. It offers true U.S. large cap stock diversification. The market cap weighted version gives most investment dollars to the largest companies. For example, Apple, Microsoft, Amazon and Nvidia currently, collectively represent over 19% of the total index. In 2023 there has been a wide difference in the return of the two indexes. The equal weight S&P 500 is presently negative since January 1st. This is because the broad U.S. stock market has not had the appreciation that the largest tech stocks have had.

Water in the Basement

With the recent storms we had in late Summer, I have been encouraging everyone to review the coverage their homeowner’s policy provides for water backup. Water backup coverage provides coverage for damage that results from sump pump failure, drain failure or sewer backup. In the recent storms, homeowners who had water in their basement experienced an average loss of about $12,000. If you have carpet, flooring or drywall in your basement, consider reviewing your coverage with Julie from our office. You can contact her at julie@nmdinsurance.com

Crosby Advisory Group, LLC provides wealth planning, business growth strategies and asset protection. CAG is a registered investment advisor. This newsletter does not constitute individual advice. Investing involves risk including the potential loss of principal. Not all investments are suitable or all people.