MicroStrategy’s Macro Strategy - How Strategy© Uses Wall Street to Stack Bitcoin

Microstrategy changed their name to “Strategy©” but the title of the post was too good to pass up. Disclaimer: I personally own shares of Strategy© Common Stock ($MSTR) as a small percentage of my assets and view it as an allocation under the Bitcoin asset class. Strategy’s convertible bond and preferred share strategy is very young and may blow up in horrific fashion, but in the meantime it appears to be working and I'm fascinated by how it has developed. I would not recommend MSTR or the preferred shares to most investors unless they have a high risk tolerance and are very bullish on Bitcoin and the Bitcoin Treasury Strategy which is not most people. This is a high risk investment, do your own research & analyze your personal risk/return objectives when buying any investment.

Overview of Strategy©

Strategy© is a US company based in Virginia, they started out as a business intelligence software company. In 2020 they developed a Bitcoin Treasury Strategy that has since been copied by other companies around the world. The strategy involves raising money through equity and debt markets and using that money to buy and hold Bitcoin in perpetuity.

The strategy has evolved and gotten more refined over time, Strategy© first purchased Bitcoin in August of 2020, they purchased $250M worth of bitcoin which represented 21,454 BTC. They were a struggling yet cash-rich software business that was watching competitors like Microsoft, Oracle, and Google eat away at their little market share and talent. While their hundreds of millions in cash was earnings 0% during covid. That initial BTC purchase is now worth 2.5B and they have since grown their BTC stack to 607,770 BTC or roughly $70B USD. Over that time, the value of Strategy© as a company went from 1.2B in August of 2020 to 128B at the time of writing. A 10,000% increase from the first bitcoin buy. Since implementing the strategy, they have outperformed all of the Magnificent 7 and Bitcoin itself. How did they achieve this extraordinary performance?

Returns as of August 11, 2020 to August 8th 2025 Source: https://www.strategy.com/charts

Price to Book Value

Asset heavy sectors are often valued based on book value - defined as Assets minus Liabilities. Real Estate, Financials, or Utility companies may be valued based on book value because their assets are critical in how they generate profits. For example, a bank’s loan book or a real estate company’s buildings are directly tied to future earnings. So investors often compare the stock price to the value of those assets.

However, for a company like Microsoft, they have a relatively small asset base compared to the value of the company. If you were to value them based on the tangible assets on the balance sheet you would be underappreciating the moat of intellectual property, network effects, and the prospects for future growth.

Asset heavy businesses are typically more valuable than the sum of their assets. The company can use their assets to generate and reinvest profits that can scale the business and use assets more efficiently. You will often see companies nearing bankruptcy being valued exactly even with or even below book value, since the only value expected is from liquidation of assets and not continuing to operate the business.

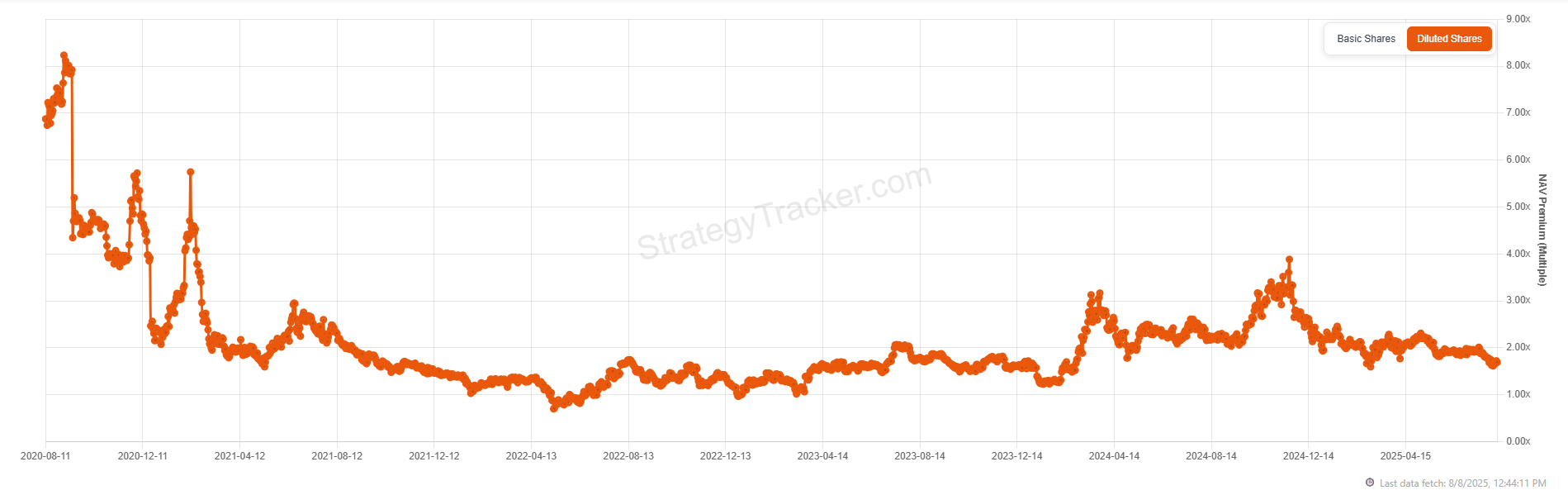

For Strategy©, their entire asset base is BTC, which is a 0% yielding asset and no other meaningful sources of revenue. They are not using the BTC for any purpose or lending it out to generate a yield, they are simply using the proceeds from selling shares to buy and hold BTC. So why would investors place a premium to book value when there are many options for investors to just go buy BTC for themselves? Right now Strategy© is worth 1.79x the net-asset-value (NAV) of the BTC they hold on the balance sheet. For this discussion, NAV can be viewed similarly to book value.

Source: Strategytracker.com

MSTR Bull Case

Investors in Strategy© believe $MSTR should trade at a premium to NAV or a multiple of NAV (mNAV). This has been a key metric for “Bitcoin Treasury Companies” that have since copied Strategy’s playbook.

Bull Thesis: A publicly traded corporation has distinct advantages for raising money in a cheap and advantageous way that isn't available to other investors. By accessing capital markets and receiving cheap financing, Strategy© can buy BTC and achieve a leveraged rate of return on a fast appreciating asset - BTC - assuming BTC continues its upward trend

Strategy© now has 5 primary ways of raising money, they can sell their common stock $MSTR or 4 other preferred shares ($STRD , $STRK, $STRF , $STRC) directly into the market during the day and receive cash. They can do this as often and as much as they want as long as there is a willing buyer for those shares.

Source: Strategy Q2 2025 Financial Results 7/31/2025

Very Brief Overview of Strategy©’s Preferred Stock Offerings:

Preferred stock typically sits above common stock in the capital structure, meaning in the event of bankruptcy, the bond holders get paid back what they are owed first, then preferred shareholders get paid and whatever is left over is given to common stock holders. Preferred shares typically pay dividends and can be viewed as a blend between owning stock & bonds. Strategy© has structured these 4 different preferred offerings to target different risk appetites of different investors. It would take forever to go through all of the specifics in the offerings but you can learn more about them here.

What is consistent across all of these preferred offerings is high dividend payments, some of which are cumulative. $STRK for example pays 8% annual dividends paid quarterly and they are cumulative, meaning if a dividend payment is missed, you are still owed that dividend and any future dividends until you are made whole. If Strategy© has 0 cash flow from operations how are the dividends paid? Won't they have to sell the BTC they have accumulated to pay the dividends? The answer is no, they will just continue to raise money via selling the common and preferred stock.

Money paid to existing investors from money coming in from new investors, how is that different from a ponzi scheme? The difference is the shares are backed by an asset that have increased in value by 64% per year on average over the last 5 years. Lets use a real estate company for a comparative illustration. If Company ABC wants to raise 100M to buy a plot of land and develop a residential building. ABC goes to the investment banks and consultants and pays hefty fees to make their investment pitch rock solid. They raise 100M from investors and start building and 5 years later they have a building with tenants/taxes/maintenance/employees/debt servicing. All of those things come with specific risk factors and I'll leave the math to you on how long it would take the investors to recoup the investment. In contrast, Strategy© sells 100M of stock in a day, without materially affecting the MSTR stock price and invests the money before the market opens on Monday morning. If it costs them 8% or 10% to finance the purchase, if BTC grows at their projected growth rate of 21% per year on average, the value in that arbitrage directly goes to the equity shareholders of MSTR common stock. The BTC on the balance sheet has 0 tenants/taxes/maintenance.

If Bitcoin does continue to appreciate faster than their cost of capital, what is Strategy© worth as a company? I don't think you can view it the same as a BTC trust or a BTC ETF that trades in line with its NAV, if they are able to continue to raise money at comparatively lower interest rates, then a premium or multiple of NAV is justified in the bull case scenario.

MSTR Bear Case

What can go wrong with the Bitcoin treasury strategy? The most obvious one is a prolonged Bitcoin bear market. Strategy© has been tested through a nasty bear market in 2022. They had a non-cash digital impairment charge of 1.28B FY 2022. At the time they had purchased $4B of Bitcoin that was marked down to $2.9B and the mNAV drew down to 0.7x. Meaning $MSTR was worth less as a company than the sum total of their assets as Bitcoin drew down roughly 75% from the 2021 peak. It's very clear that if Bitcoin goes to 0, then Strategy© will also go to 0. The more interesting case is if anything will cause Strategy© to blow up while Bitcoin continues to grow or remain where it is today.

Strategy© did not have to sell any Bitcoin in 2022 despite the violent short term drawdown. This was primarily due to the way Strategy© structured their financing. They used 0% coupon convertible debt that matured many years into the future. This allowed them to not have any cash outflow requirements and could hold over any short term market turmoil. When the debt comes due, the debt can be paid by issuing more $MSTR common stock to pay the bond holders.

In 2025, their strategy has evolved from issuing 0% convertible bonds to issuing preferred stock with quarterly dividend payments at 8-10% of par. This adds an additional risk, they now have a cash outflow need to pay dividends on billions of dollars of preferred shares. The dividends will be paid both in cash (from selling $MSTR) and paid directly in shares of the preferreds or $MSTR, notice the pattern?

The bears are concerned that all of the share issuance will weigh on the performance of $MSTR common stock. Share dilution ends with investors owning less and less of the company over time. Today, Strategy© 's market capitalization has reached an all-time high, yet its stock price remains nearly 15% below its historical peak due to share dilution.

Notable short seller Jim Chanos, who made his mark by shorting Enron in 2001, is placing a bet that the mNAV on $MSTR should be 1. Driven by the copy cats of the Bitcoin treasury strategy, and because of the massive share dilution that needs to happen to continue to accumulate Bitcoin and pay dividends on the preferred shares. If he is correct, the shares of $MSTR would be trading at $252 per share or -37% lower than where it is today.

Bitcoin does not have to go to 0 for $MSTR to significantly underperform Bitcoin and cause the mNAV to go below 1. If Bitcoin fails to grow faster than the cost of their financing, that is value destruction or capital misallocation. It would be as if you are buying treasury bills on your credit card, the value of your balance sheet will trend towards 0 and you would have to dilute the equity at a greater and greater rate to pay the dividends.

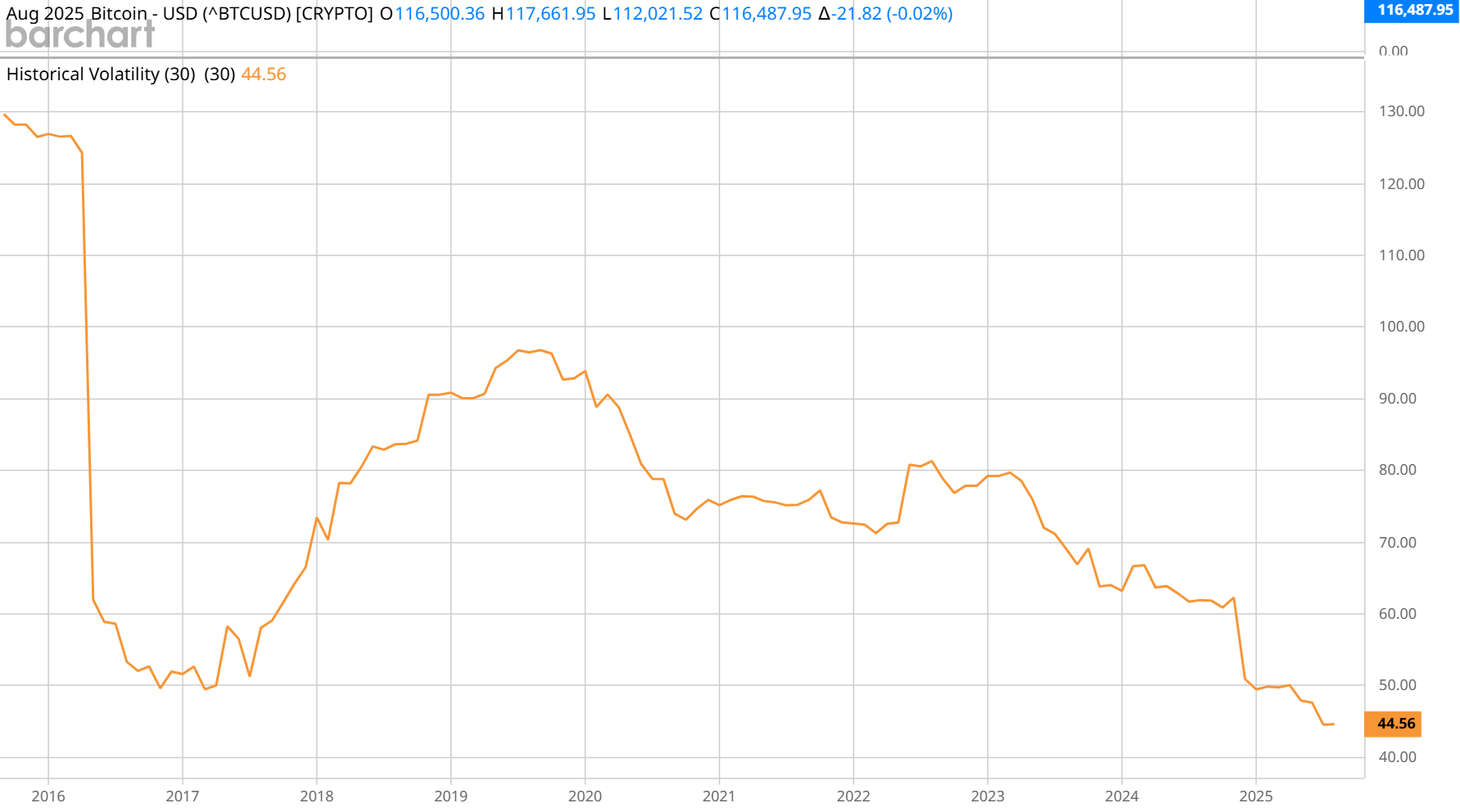

Its also unclear how this strategy works in the long run, even in a bull case scenario for Bitcoin, the law of large numbers tells us that the volatility of Bitcoin will decrease as time goes on and if it becomes an institutional grade global asset class. Strategy© is issuing perpetual preferreds, so these never come due or mature. The future is uncertain, and we don't know how the strategy will evolve over the next 30 years lets say, but its unclear what happens if Bitcoin’s annual rate of return declines from the high levels we see today and Strategy© will still continue to pay 8-10%.

30 Day Bitcoin VolatilitySource: Barchart.com

[Hypothetical numbers for illustration purposes] There is a mechanism to lower the coupon rate over time, for example if these shares are offered at $100 par value and pay 10% coupons, the shares will still get bid up by investor demand, but the coupons stay the same. Strategy© is able to sell these directly into the open market during the day. So if the market drives these shares to $200 for example, Strategy© can sell new shares for $200 but still only has to pay $10 in coupons. So the effective interest rate goes from 10% when the shares are first offered to 5% and that will over time be the effective interest rate for Strategy©.

Conclusion: Is Strategy© the next FTX or Enron?

I don't believe liquidation risk is likely in the case of $MSTR. I cant comment on every other Bitcoin treasury company or how Strategy© may raise funds in the future. The risk is exclusively borne by owners of $MSTR. Strategy© has a monopoly on the ability to print an infinite amount of $MSTR shares. As long as those trade at any positive value, the dividends can be paid at the expense of common stock holders. The upside for $MSTR is arbitraging the relatively cheap 8-10% cost of capital and getting a leveraged return on Bitcoin. According to Executive Chairman Michael Saylor, his forecast includes a 21% compounded annual growth rate for Bitcoin over the next 21 years.

Strategy© has the 9th largest corporate treasury compared to S&P 500 companies as of July 19th. They are expected to report a $14B gain from the Bitcoin strategy on July 31st 2025. Their most recent preferred offering is the largest IPO of the year raising $2.5B. This along with the other preferred IPOs have raised $4.8B since January.

Source: Strategy Q2 2025 Financial Results 7/31/2025

Strategy© is a private market actor that is contributing to the capitalization of the Bitcoin asset class. Offering financial products for different classes of investors backed by Bitcoin. Bitcoin is a 2.3T asset class, global bond and real estate are a combined 600T asset class. The demand for bonds and real estate is capital appreciation and cash flow, Strategy© is building products to pull capital from bonds and real estate into Bitcoin. There is clearly demand for these offerings as measured by the amount of money they are able to raise in initial offerings. Its unclear if they will be able to continue to raise billions or if this is all over zealous leverage that will end up in catastrophe.

Another Disclaimer: CAG is a registered investment advisor, we do not currently own or recommend $MSTR or Strategy© preferred stock for any of our clients. This post is not a recommendation to buy MSTR or any of the preferred shares. The author owns $MSTR common stock, $MSTR, Strategy© preferred shares, & Bitcoin are volatile and speculative investments. They carry specific risks that other asset classes do not share. Do your own research before considering an investment in Bitcoin or any other Bitcoin derivative. Investing involves risk including the potential loss of principal and previous returns are not indicative of future results.