Which Asset Classes Led 2025 (Part 1)

Which Asset Classes Led 2025 (Part 1)

The goal of investing is not to have 100% of your portfolio allocated to the best performing asset class every year. Investing involves mapping out the potential outcomes that could happen over a timeframe where you can make reasonable assumptions about the future and predict the first, second, and third order effects of those outcomes and which asset classes will do well in that environment and which will do poorly. It's impossible to predict every year which asset classes will outperform and which will underperform with exact accuracy. With hindsight however things are much clearer and seemed inevitable. This isn't meant to be an exhaustive list of every single asset class, but just some asset classes that won (Part 1) and lost (Part 2) in 2025 and the interesting stories behind why that is.

Introduction

A key driver of returns this year was the weakness in the US Dollar. This weakness contributed to the outperformance of international stocks and precious metals. We believe this trend is durable into 2026. In the US, AI drove the majority of the returns while the rest of the stock market struggled. We believe the AI narrative might come under scrutiny in the first half of 2026. The AI hyperscalers are running into bottlenecks with powering the large data centers which could limit progress in the AI models which can hurt bullish sentiment in the AI names. Gold and precious metals have been helpful for US investors in hedging the devaluation of the dollar and we believe gold serves an important role in portfolios and will continue to do so in 2026.

Winners

International Stocks

Emerging Markets

Emerging Markets (EM) have not given investors anything to get excited about for the better part of two decades. This year, they crushed US markets by a wide margin in USD terms. When investing internationally, there are two components of your return, one return is the return of the underlying investment in local currency terms. If a European investor buys a European company for €100 a share, they will pay for shares of that company in euros & if their position increases 10% and lets say they sell for €110 a share. Since their expenses are in € their returns end there and they can spend the €110. If a US investor does the same transaction, they first must convert their $ into € and then complete that same transaction. So there is foreign currency exposure when investing internationally. If a US investor does that same transaction but over the same holding period the $ appreciates against the € by 10% the return for the US investor will be -1% (the local currency returns & foreign exchange returns are multiplicative not additive). Most international funds offered to US investors will not hedge this foreign currency exposure.

Another reason for EM outperformance is because of their dollar denominated liabilities. In a lot of EM, the local currencies are unstable, and big lenders may be fine to lend money to EM companies but they don't want to be paid back in a currency that may or may not be worthless by the time the debt is fully repaid. So they will lend money to EM companies & governments denominated in USD. So when the dollar weakens, it's a big tailwind for those companies who effectively get discounts on their debt service costs in a year where the dollar declines like it has this year. Also, commodity exports are a large part of EM economies which helps local currency returns when the prices of commodities are rising, because they are selling commodities to developed markets.

Image: DXY (US Dollar Index YTD Returns as of 12/24/2025) Source: Trading Viewhttps://www.tradingview.com/chart/IhZDMXK8/?symbol=TVC%3ADXY

International Developed Markets

One market in particular is fascinating to highlight. Japan has been caught in a deflationary trap for the past 30 years. Books have been written on the causes of this stagnation in the Japanese economy. If you invested in the Japanese stock market in December of 1989, you would have finally broken even last November. Japan has been in a period of ultra easy monetary policy for decades to try to break out of this deflationary trap they found themselves in. Post Covid however, due to a tight labor market and rising wages, there has finally been life in the Japanese corporate sector. The Nikkei 225, which is the Japanese stock market index on the Tokyo stock exchange, has posted 3 consecutive years of high returns. I will leave an extended review into the brief history of the Japanese economy and outlook for a later time. There are still many cross currents that can resolve very bullish or very bearish, and it's worth taking a deeper dive given their recent stellar performance.

Conclusion

We think there is a clear path for continued international performance, equity investors have only had one option for a long time, and that is to continue to allocate to US markets. Continued USD weakness will lead to a positive foreign exchange contribution to returns but there is still country specific risk in each market. Each international market has its own set of challenges going forward, and completely different tax, governance, policy regimes that must be monitored before investing in these markets.

Nvidia and The Magnificent 7 (and Major Challenges Going Forward)

2025 was another blockbuster year for the AI “Hyperscalers” specifically Nvidia & Google. At this point I imagine everybody has had at least a little experience with some of the LLMs like ChatGPT, Gemini, Grok, or at least been annoyed by the horrible AI content people share on social media. If there was any doubt last year if AI was going to stick around for the long run, that has been put to bed. The AI boom is real and here to stay, the technology will have an immense unpredictable impact in our lives. Unpredictable in both the applications, the scale, and the consequences. The next shoe to drop on the AI narrative will be focused on US energy production and less on raw computing power of Nvidia chips.

Constraint #1 Rare Earth Minerals

We are currently in a full Cold War style AI race with China. One of the key battlefields in this cold war is trade. Throughout 2025, there were ongoing discussions between US & Chinese trade officials around tariffs & flow of rare earth minerals to the U.S. from China. The US is completely reliant on China for rare earth minerals that are absolutely critical inputs for semiconductors and by extension key inputs for our weapons and national defense. As part of the trade negotiations, China agreed to a 12 month delay in export controls for rare earth minerals. If the plan is to onshore semiconductor manufacturing in the US, the critical first step is to allocate our own supply of rare earth minerals.

Find more statistics at Statista

Constraint #2 Energy Infrastructure

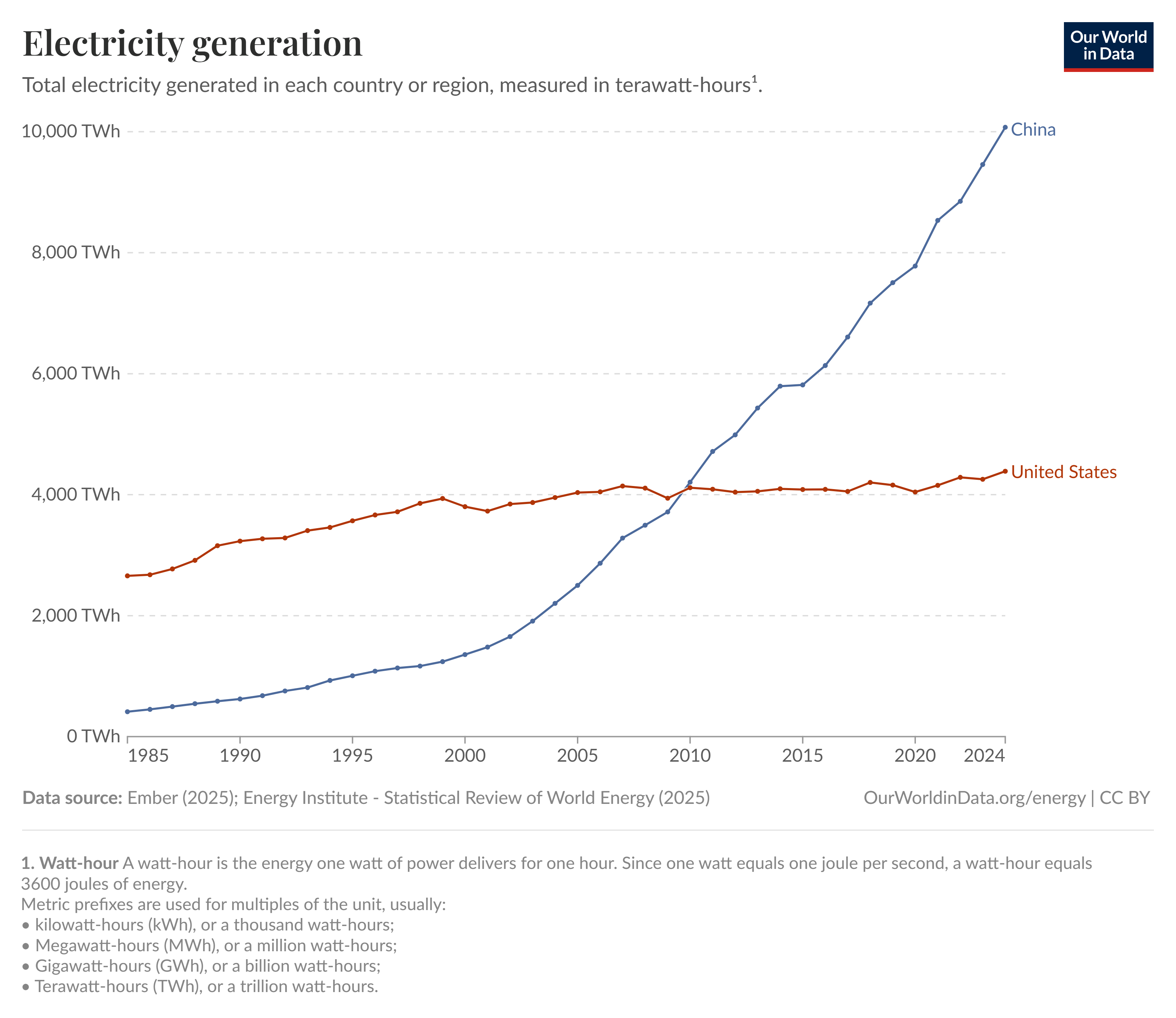

So far, the US is winning the battle for AI hardware. Nvidia has run away as the leader in GPUs that power the AI models. Microsoft, Google, Meta, Amazon, Oracle, Tesla and others are planning to spend hundreds of billions to acquire and run Nvidia chips. The major constraint in the near future will literally be we do not have enough power in our electric grid to run these data centers. According to Pew research, US Data centers consumed 4% of the country's total electricity. Electricity consumption at US data centers is expected to double by 2030. If the next battlefield in AI supremacy is electrons, the U.S. is fighting at a deficit because we have not put as much emphasis on modernizing our infrastructure relative to China.

Source: https://ourworldindata.org/grapher/electricity-generation?tab=line&country=USA~CHN&mapSelect=USA~CHN

The leaders and insiders of the AI revolution have stated their concerns very clearly. The CEO of OpenAI (ChatGPT) Sam Altman was asked in an interview with economist Tyler Cowen, “why don't we just make more GPUs”, Altman responded “Because we need more electrons." He went on to say that electrons are more of a constraint for the continued progress of AI than more computation. CEO of Microsoft Satya Nadella said they have GPUs sitting in inventory because they can't plug them in, Mark Zuckerberg has stated energy constraints are holding back AI data center buildout and they would build bigger clusters if they had the energy to do it, and there are many other examples. These are problems that cannot be solved overnight, it's also unclear what the solution will be.

Conclusion

AI or AI adjacent companies have driven most of the returns in the US in 2025, this has been great for passive investors that invest in the Nasdaq 100 or the S&P 500. Beware of the concentration in these AI investments, there are material headwinds that are not easy fixes. The market is very bullish on AI, that can change based on sentiment. The market can change in an instant and get bearish on the AI narrative even if these companies continue to produce record profits. We are still bullish on AI companies and we think there is a long runway for growth but the road will not be linear and will get choppy. Make sure you are aware of the concentration risk in the Mag 7 if you are a passive investor.

Precious Metals

Gold is money, everything else is credit - JP Morgan (1912)

Biggest Buyers of Gold

The US has a vested interest in propping up neutral reserve assets like gold to rebalance global trade. The post-WW2 era was defined by a period of increasing globalization. The USD was established as the global reserve currency and the US was the global hegemon after the Cold War. We supplied the world with dollars, and we benefitted from the cheap manufacturing from across the world. This arrangement is great for US capital markets because the dollars we send out are invested in US markets and that lead to our strong performance in stocks, bonds, land, commercial and residential property, etc. The downside is, we end up being overly reliant on other countries for manufacturing and foreign investors end up owning a larger percentage of US assets over time. I have discussed this in the past; you can read further here and from many other knowledgeable sources.

In the last section, I discussed two major challenges facing the US if we want to maintain our status as the global hegemon. First, continued technological and economic leadership, this comes from the US being the global leader in the AI race, I discussed briefly the trouble US companies will have if we do not quickly expand US energy production. Second, the projection of strength abroad will come from our military and defense capabilities. I also discussed briefly our reliance on our main adversary to source the critical inputs for our military and defense.

China on the other hand wants to decouple from the US dollar and US dollar backed system. They have been the major architects of the BRICS group, potentially signaling a bifurcation of global power split between hemispheres. The first step is reducing exposure to the US treasury market as a percentage of their balance sheet, which they have been doing for more than a decade.

Both China and the US can benefit by settling in neutral reserve assets like gold. The US would benefit by decreasing the value of the dollar and making US exports more competitive, we would also benefit because the value of the national debt would fall in purchasing power terms, we are also the largest official holder of gold. China would benefit because of their increased influence on the global stage by the US taking a relatively smaller role, China also has vast gold holdings both official and unofficial.

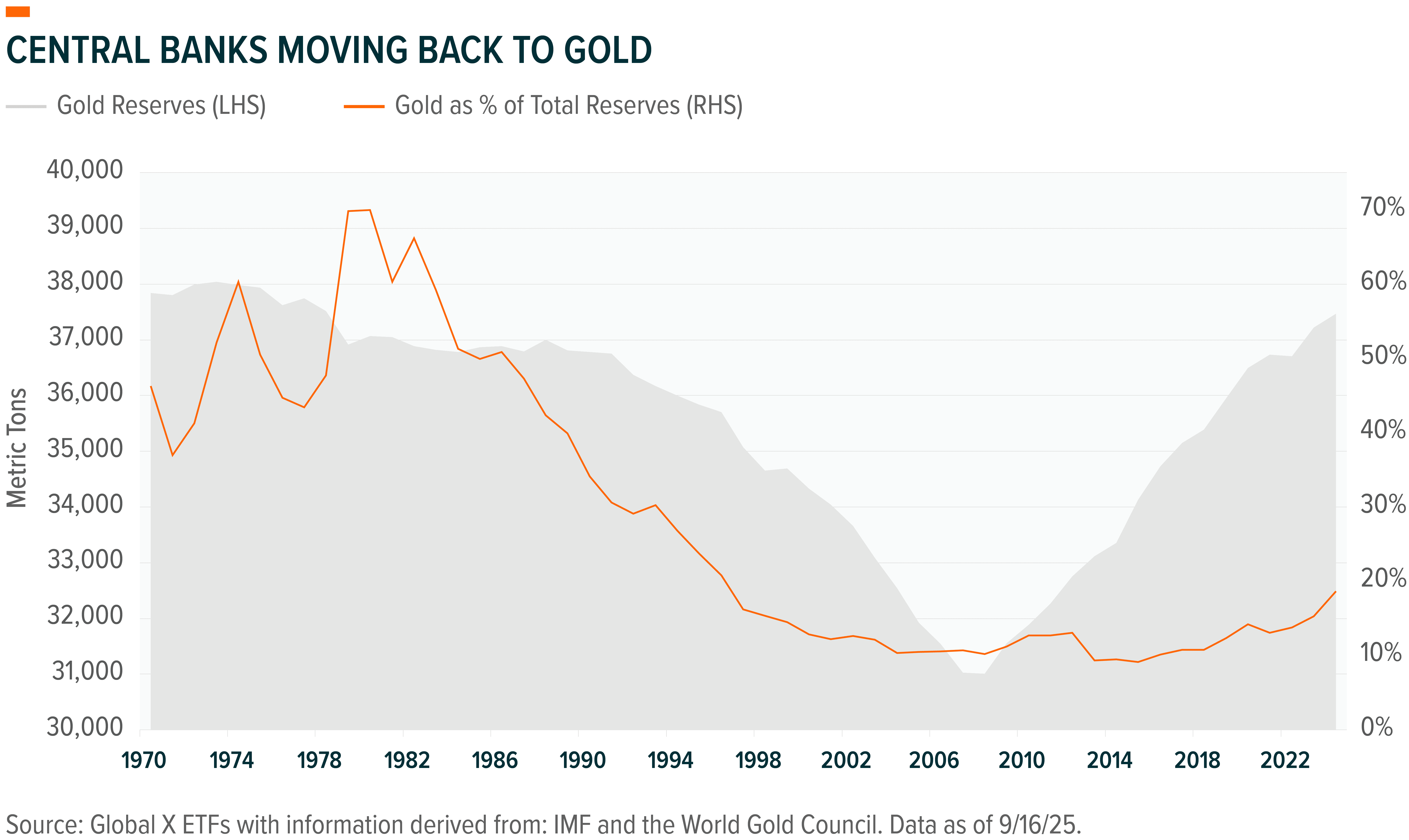

Gold in a Multi Polar World

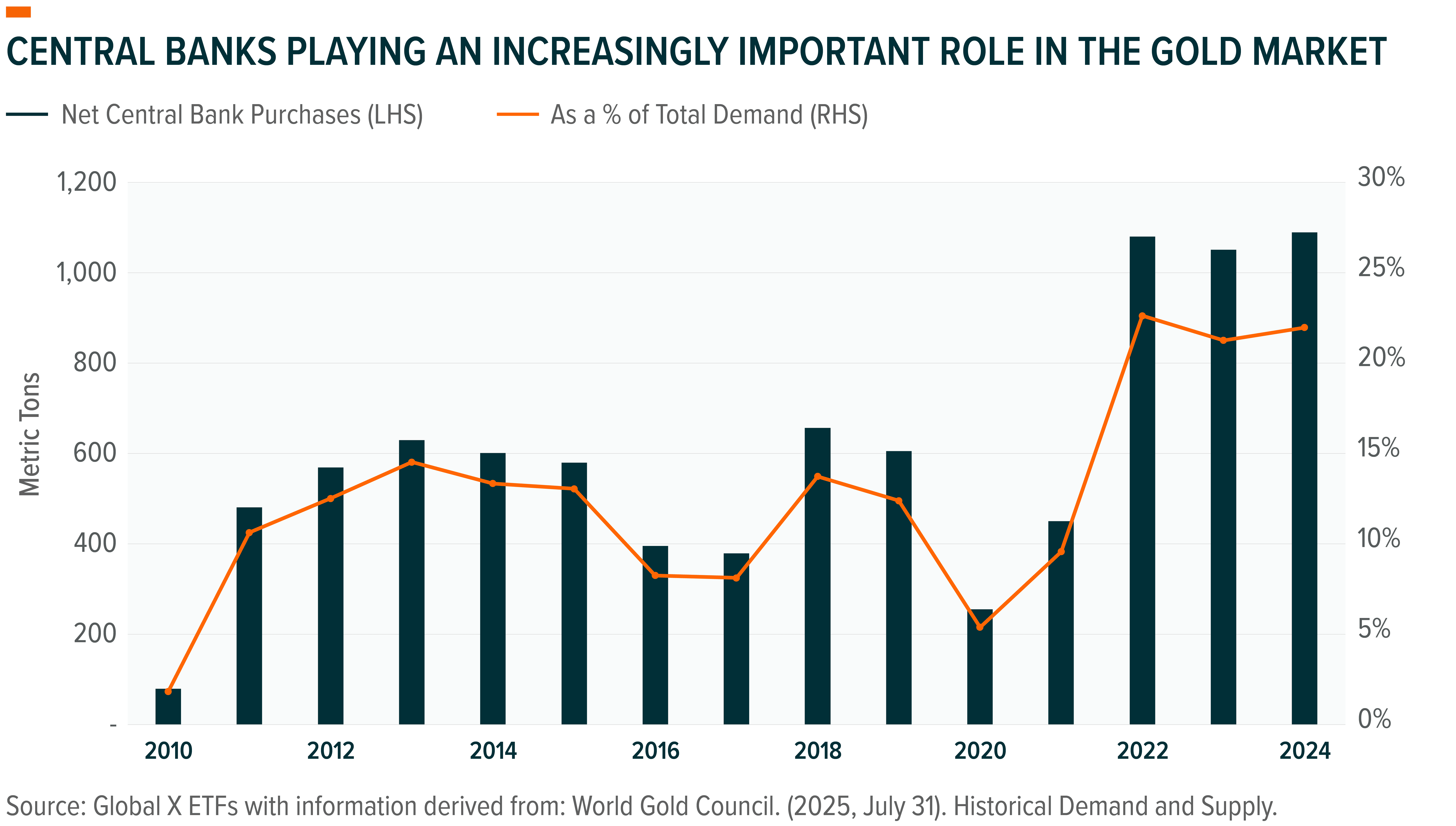

According to Global X ETFs, with data from the World Gold Council, central banks are accumulating gold at a record pace. If we are truly entering into a multipolar world, there will be less demand for US treasury debt, and more demand for neutral reserve assets like gold and potentially silver and Bitcoin. Central bank gold holdings as a % of total reserves has been steadily declining since 1980. Gold was simply not needed in the time of increasing global cooperation and a singular global super power as the global reserve currency.

Since the bottom of that chart in 2014, it has been consistently rising year after year. Given the weaponization of US dollars against Russia, and the exponentially increasing national debt, US bonds are not as safe as they used to be. To be a prudent manager of central bank assets, it makes sense to accumulate reserves in USD because a majority of global trade is still settled in US dollars, but it also makes sense to accumulate neutral reserve assets especially gold if we are potentially entering into a world not dominated by a single entity.

Source: https://www.globalxetfs.com/articles/commodity-catchup-why-are-central-banks-buying-so-much-gold

Gold in Investor Portfolios

Our view on gold from a portfolio management perspective has always been to buy and hold uncorrelated assets, this allows for higher risk adjusted returns holding all else equal. Gold has historically been seen as a defensive asset in portfolios. When there is a crisis, gold typically outperforms. Since 2023 onwards, gold has not just been uncorrelated, but it has outperformed stocks in a bull market.

We don't believe investing in bonds will offer the uncorrelated returns that it has offered in the past. The belief behind the traditional 60/40 portfolio is stocks and bonds are uncorrelated and US Treasuries and investment grade bonds are a flight to safety asset. This historic relationship has been breaking down; US stocks and bonds are now exhibiting more correlation than in the past. That is a problem for portfolios that are passively invested in 60/40 style asset allocations.

Source: Portfolio Visualizer

Gold as a Hedge for US Investors

Lastly, a healthy gold allocation for US portfolios hedges the negative impact of US dollar depreciation in portfolios. A declining US dollar is actually a tailwind for large US corporations because these are global corporations operating internationally. However, for US investors investing domestically, the declining USD will weigh on your investment performance on a real purchasing power basis. One way to hedge that we already discussed, you can invest internationally and unhedge the foreign currency returns. To do this requires more fundamental analysis on the foreign companies you invest in, different tax regimes, growth and inflation regimes, as well as a whole different macroeconomic environment. A much simpler way to hedge against USD depreciation is just to buy gold which will do well in USD depreciation and also do well as more portfolios & balance sheets are allocating a larger share of their pie to gold.

Conclusion

I've laid out a few different reasons driving our bullish view on gold, all of which are durable trends that could last years. We have been bullish on gold for many years and expect gold to work better in portfolios relative to longer duration bonds. According to the World Gold Council, Q3 2025 central bank gold buying is up 10% YoY and continued strong inflows for gold ETFs. Given the rapid price increase there is possibility that gold trades flat or even pulls back in 2026 but that is not our base case view. We expect continued gold outperformance relative to US stocks in 2026, we would look to add more if there was volatility in the price of gold.

Disclaimer: Crosby Advisory Group, LLC is a registered investment advisor. This podcast is for general knowledge and is not intended to be individual investment advice. Investing involves risk including potential for loss. Understand all risk and fees before investing. NMD Insurance is affiliated with Crosby Advisory Group, LLC.