Where have investors found growth in 2019?

We have just a little over ¾ of 2019 in the books. What is the takeaway so far? I’d say it’s a reminder that diversification allows us to participate in some growth, wherever growth occurs. So far in 2019, the best growth hasn’t come from the usual suspects.

When we think of growth, as investors, we often think of high-flying companies like Amazon, Apple, Facebook, Visa, Salesforce.com or Alphabet. While 2019 has not been unkind to pure growth stocks, the highest percentage in growth has come to asset classes and sectors of the economy that are historically defensive in nature. As of the third quarter end (09/30/2019), Real Estate has led all sectors at a whopping 29% return. So much for slow and steady. The Utilities sector finished the third quarter up 23% and another historically defensive sector, Consumer Staples, finished 21.3% up from January 1, 2019.

Source: Schwab Center for Financial Research, FactSet (for YTD total returns) and S&P Dow Jones Indices (for S&P 500 sector weightings). Sector performance data is based on total return for each S&P 500 sector subindex (see “Important Disclosures” for index definitions). Sector weighting data is as of 09/30/2019; data is rounded to the nearest tenth of a percent, so the aggregate weights for the index may not equal 100%.

Past performance is no guarantee of future results.

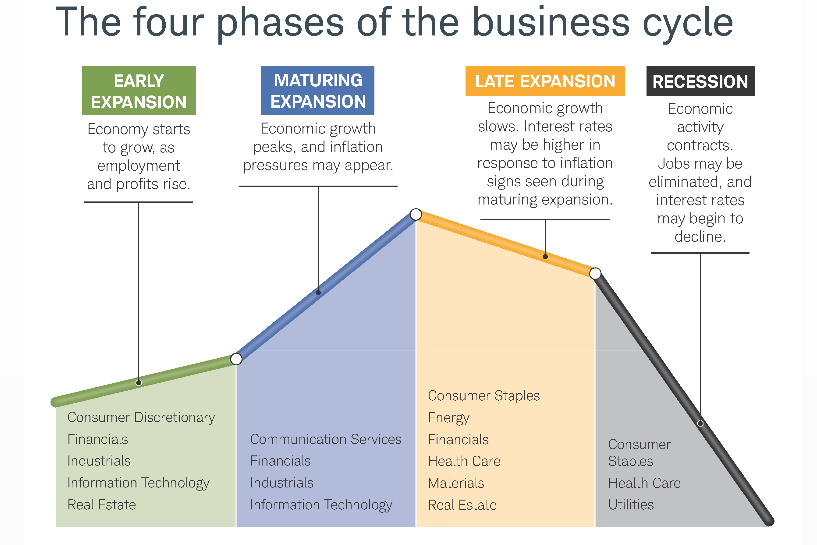

Overtime investment markets tends to move up and to the right, but markets certainly do not grow in a straight line. Additionally, different classifications of investments come in and out of favor like seasons, as we move through the business cycle. We may get a clue to where we may be in the business cycle by paying attention to what sectors are leading in growth. An investment environment led by Real Estate, Utilities and Consumer Stables may indicate we have entered late expansion. While Crosby Advisory Group, LLC believes this is the case we must be careful and consider all information. Typically, in a late expansion period, the Healthcare sector and Energy sector should also be doing well. However, we presently find those two sectors to be among the dogs of 2019. Healthcare is facing the specter of an election year where candidates have very different views on if Healthcare should or should not be government controlled. I believe this very much plays into a big part of the Healthcare sector’s woes thus far in 2019.

Reading the landscape and investing accordingly is still very much an art as much as it is a science. One thing remains certain. Diversification allows investors to reduce risk while increasing the potential to participate in growth, wherever that growth occurs.