What Are Structured Notes?

I wanted to go into a bit more detail on how they actually work and what's going on under the hood that can give you something that seems too good to be true on the surface. 100% downside protection with potential for 9% returns sounds great. I wanted to go into some more depth on how this is achieved and why creating this inside of the ETF wrapper is even more beneficial than creating it from scratch.

____________________________________________________________________________________

Terminology: Will use Ticker $SPY (S&P 500 ETF) for simplification purposes. Dollar Amounts are hypothetical for illustration & simplification

Call Option: Contract that gives the buyer of the call option the ability to BUY $SPY at a predetermined price known as the Strike price at a future date.

Example: $SPY @ $100 Strike on 12/31/2025

The buyer of a call option gives them the ability to buy $SPY for $100 on 12/31/2025. If the price of SPY on that date is $200, the buyer of the call option can buy SPY for $100 and sell it in the market for $200 for an immediate $100 profit

The seller of the call option is selling that ability to buy SPY @ $100, the buyer pays the seller a fee (a premium) for that ability at the initiation of the contract

Put Option: Contract that gives the buyer of the put option the ability to SELL $SPY at a predetermined price known as the Strike price at a future date.

Example: $SPY @ $100 Strike on 12/31/2025

The buyer of the put option gives them the ability to sell $SPY @ $100 on 12/31/2025. If

the price of SPY on that date is $50, the buyer of the put option can still sell $SPY at $100

making a $50 profit

The seller of the put option is selling that ability to sell SPY @ $100, the buyer pays the

seller a fee (a premium) for that ability at the initiation of the contract

____________________________________________________________________________________

To build these structured products from scratch, you are basically selling all of the potential upside of holding the underlying security ($SPY), and somebody is willing to buy all of the upside and will pay you a fee (a premium). Then using that premium, you can go purchase downside protection. So you have basically just modified the return characteristics of owning SPY. Instead of being exposed to the full downside and the full upside, you just modified it so now you can only experience a narrow range of returns.

A more concrete but simplified example: Let's assume you own 100 shares of SPY, if you wanted to buy 100% downside protection for the next year, you can buy a put option at the strike price of whatever the stock is trading at right now.

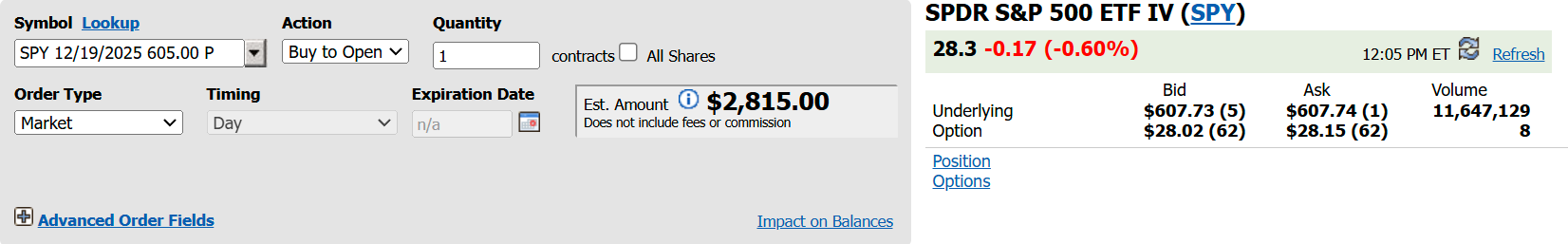

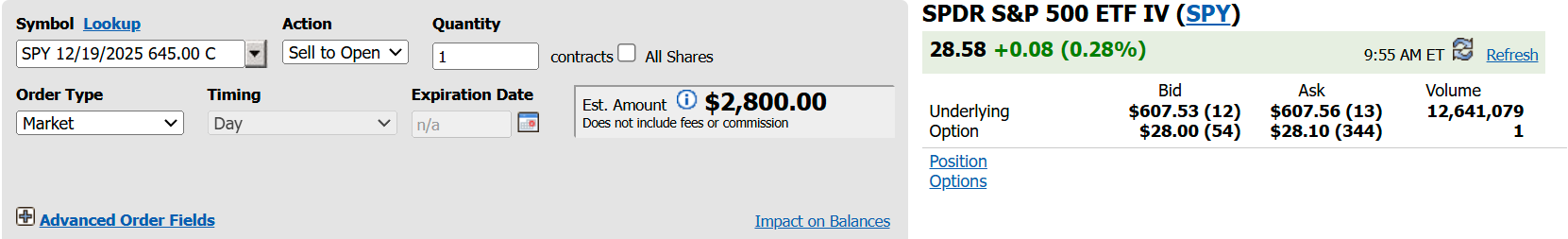

These quotes are subject to a lot of change, these quotes are for illustration purposes only. As of 12/6/2024, 100% downside protection would cost you $2815, that would cover 100 shares of SPY for 1 year. If you purchased the put option, it would give you the ability to sell your shares at $605 in 1 year no matter where the stock is trading at on 12/19/2025 (the expiration date for that particular contract). If SPY is trading at $300, you can still sell at $605, if its trading at $700 you simply dont exercise the ability to sell and the put option is worthless but you still own the 100 shares.

Instead of paying $2815 for that insurance, you can just sell some of the potential upside to fund it. By selling a call option on SPY, you receive money today for selling the right for somebody else to buy shares at a predetermined price. Since the goal is to fund the downside protection, you want to look in the market and see how much of the upside you have to sell to fund the purchase of the put options.

In today’s market, you can sell the $645 strike call option for $2800 and use that money to fund the put option which functions as an insurance policy on your portfolio.

____________________________________________________________________________________

Here is an illustration of the payout in different scenarios

Scenario 1: The Market Goes Up to $700

1) You own 100 shares of the underlying worth $605 today

2) You own a put option at a strike price of $605

3) You sold a call option at a strike price of $645

1*) Your shares are now worth $70,000 -> A gain of $9500

2*) Your put option expires worthless: You have the ability to sell at $605, but you wouldn't want to do this if you can sell in the market for $700. You paid $2815 for this contract

3*) The call option is negative: You have sold the ability to buy shares at $645, meaning the buyer of that call option can buy 100 shares from you at $645. Since the market price is $700 that represents a loss of $5500, but you still collected $2800 in premium.

Your overall position would be positive by +9500 -2815 + 2800 - 5500 = +3985

A 6.6% return on $60,500 (100 shares of SPY)

Scenario 2: The Market Goes Down to $500

1) You own 100 shares of the underlying worth $605 today

2) You own a put option at a strike price of $605

3) You sold a call option at a strike price of $645

1*) Your shares are now worth $50,000 -> A loss of $10,500

2*) Your put option has value: You have the ability to sell 100 shares at $605 -> a gain of $10,500. You paid $2815 for this contract

3*) You sold the call option for $2800, since that gives the buyer of the call option the right to buy shares at $645 that option is worthless. The buyer of the call would not buy shares for $645 when they can buy shares in the market for $500

Your overall position would be Negative by -10,500 + 10,500 - 2815 + 2800 = a loss of ($15)

A 0.0% return on $60,500 (100 shares of SPY)

Scenario 3: The Market Goes to $625

1) You own 100 shares of the underlying worth $605 today

2) You own a put option at a strike price of $605

3) You sold a call option at a strike price of $645

1*) Your shares are now worth $62,500 -> A gain of $2000

2*) Your put option expires worthless: You have the ability to sell at $605 but you wouldn't want to do this if you can sell in the market for $625. You paid $2815 for this contract.

3*) You sold the call option for $2800, since that gives the buyer of the call option the right to buy shares at $645 that option expires worthless. The buyer of the call would not buy shares for $645 when they can buy shares in the market for $625

Your overall position would be positive by +2000 -2815 +2800 = +1985

A 3.3% gain on $60,500 (100 shares of SPY)

____________________________________________________________________________________

Conclusion:

As you can see, this trade protects 100% of your downside but limits participation of the upside to the strike price of the call option. You sell the call option to fund the protection on the downside. You also notice that you get full upside participation up to that point. Options can be a very useful tool in risk management, but you may have also noticed this is a pretty expensive trade to put on for lower account values. This trade would require 100 shares of the underlying, for lower account values you can accomplish the same trade by using the Buffered ETFs which trade at around $27 per share at the time of writing.

Disclaimer: Crosby Advisory Group, LLC (CAG) is a registered investment advisor and licensed insurance firm. We provide financial planning, business growth strategies and insurance services. Any investments mentioned in this newsletter should not be taken as individual investment advice. Investments possess varying levels of risk and you should understand all risks and costs before making an investment. Not all investments are suitable for all investors.