Unearthing Rule of 20 and Mountain Wisdom

Could the Rule of 20 be the Rosetta Stone of Investing?

For many years understanding ancient Egyptian hieroglyphs were a mystery. The discovery of the Rosetta Stone, named after the town it was discovered in 1799, helped unlock the ability to translate Egyptian writing since the message on the stone was written in both hieroglyphs and Greek.

Investors have long searched for their version of the Rosetta Stone, an indicator that allows investors to decipher market conditions to make perfect buying and selling decisions. A recent article published in the Wall Street Journal suggested that the Rule of 20 had a perfect track record of calling Bear Market (down market) bottoms. The claim was too enticing for us not to unearth the truth.

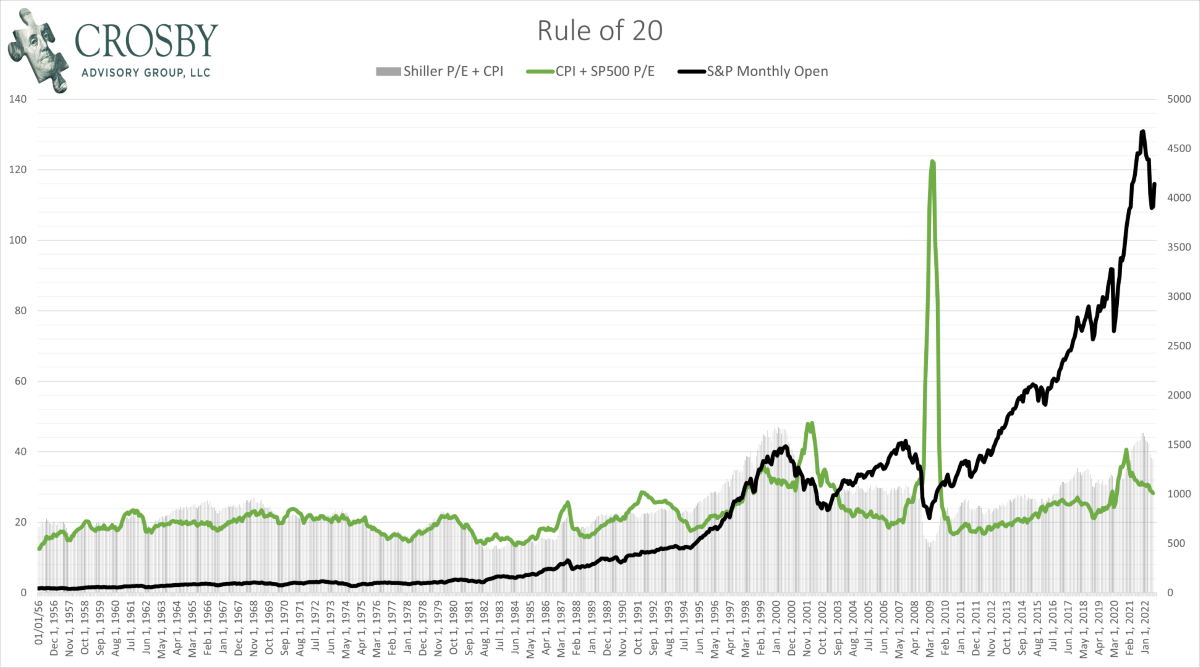

What is the Rule of 20? It is a calculation that attempts to determine the fair value of the stock market. It is calculated by taking the average P/E (price per share divided by earnings per share) and adding the current inflation rate as measured by the consumer price index (CPI). If the sum of those two data points is below 20, the stock market is considered undervalued. At 20, the stock market is considered fair value. A sum that exceeds 20 is an indication that the stock market is overvalued. Presently, the average P/E of the S&P 500 company is slightly above 20, which suggests historically speaking, the market is still overvalued even before we add in the current inflation rate, which is 8.5% based on last month’s CPI.

Does the Rule of 20 always hold true? Without even having to run the numbers we knew there was an inherent flaw to this rule. The stock market rarely trades at fair value for very long. Using the rule of 20 (green line below), it is easy to see that most of the time the stock market is either over or under valued. In fact, the stock market can remain overvalued for many years at a time, and still appreciate significantly. Additionally, when our own Derek Ballinger ran the numbers, it became evident that the Rule of 20 was cherry picking the Bear Market Bottoms. The Rule of 20 failed to call the bottom during the Dot-Com crash of 2000-2001, the 2008 Housing Market Crash of 2008, and the Covid downturn of 2020.

While the Rule of 20 is useful for considering the relative value of the stock market, it is not the perfect indicator of market bottoms some claim it to be. Markets trade over and undervalued most of the time. The superpower that levels the field is not a fancy calculation, but rather the ability to patiently hold quality investments over many years and decades.

Marketing in a Recession

Whether we are investing in them or running our own, we like to see businesses get the most out of their marketing dollars. While that is true in any market, it is especially true in a recession when resources can be tight. Some businesses weather recessions better than others, and some even find ways to gain market share. What separates these companies? How can businesses ensure they are getting the best value for the marketing dollar? What is the number one action businesses can implement during a recession to maintain their customer base? Our marketing expert Carly Snyder answers those questions in a recent Dynamic Growth podcast. You can listen to it here.

Mountain Knowledge

Just outside of Minturn, Colorado, in the Holy Cross Wilderness Area of the White River National Forest sit two pristine, remote mountain lakes called Sopris and Brady. I recently spent a number of days camped in a tent above those lakes. I had asked a life-long friend who had been a resident of the area to take me backpacking. I don’t think I’ve been that physically tested since three-a-day practices at Mount Union, but I loved every second of it.

I was reminded that the moments that shape us never occur on the easy path. As growth minded individuals, it is obstacles in all forms which we seek. We welcome them not purely for the challenge, but for who we become as we surmount them. This is what I left those mountains knowing.

Mountains are climbed one step at a time. In less than 24 hours I left my comfortable bed which sits at an elevation of roughly 880 feet and went to sleep on the ground beside a mountain lake at 11,000 feet. I can attest that altitude sickness is no joke 😊. Like all tough times, it eventually passed, and the next day we climbed to 12,000 feet. For an Ohio boy, at that altitude, every step was an act of will. My friend who accompanied me is part mountain goat. There were times I would see him a hundred yards above me, patiently waiting on a ledge or bolder for me to catch up, while pretending he was just pausing to admire something. Good leaders have a way of getting people to elevate themselves to new heights on their own.

When we face new obstacles for the fist time, chances are there are people we know who have already surmounted them. Look for those people. Bring them into your life. They can help. I remember being only half-way up one of the mountains we climbed and thinking, “I’m not sure I have it in me to finish this climb.” Then my friend would move up another hundred yards and I’d set a new goal of just getting to him. Just one more step. I can do that. Then just one more step. I repeated that process until I was standing on top of the mountain. That is how big intimidating mountains are conquered. One step at a time. Eventually, the mountain will run out of resistance. A good friend by your side sure helps too.

Happiness is not about me. On the third evening, a storm blew in and I retreated to my tent early to wait it out. Solitude has a way of recalibrating your mind. I had no cell connection or devices to pass the time. As the rain fell and the wind shook my tent, I became acutely aware that my thoughts were not on myself. I was thinking about my wife and children. I was grateful to be a part of their lives. I was robbing myself of spending days with them, but I knew I would be a better husband and father than I was before I left. I thought about my team at work, and how amazing they are. It is humbling to think those people believe our mission is important enough that they dedicate 8-10 hours of their day. The common denominator is love. Love is an emotion that arises when something is more important than yourself. It is impossible to suffer emotionally when your focus is on others. Think about that. Emotional suffering can only occur when the focus is on us.

What I need, I have. Removing can help you add. On the first night I laid in my tent unable to catch my breath. I had a pounding headache, and I was terribly nauseous. “If only I could beat this sickness, I’d be fine.” On the second night my therm-a-rest (air mattress) popped which meant for the next three nights I would have to sleep on the cold ground. Temperatures dropped in the 30s at night. “If only I had a sleeping pad, things would be fine.” By the fourth night I was ready to come home. “If only I was with my wife and children, everything would be perfect.”

I woke up one morning and realized that I was drinking my instant coffee, that was heated by a flame, in the same cup I fried mountain trout in the night before. At home I have plates and dishes that literally never get used. Out on that mountain, I got by with just a metal cup. As I sit here, back in Ohio, back where I have more oxygen than I need, I realized that I have my health, I have a comfortable place to sleep, and the people I love. What I really desire, I already possess.

Disclaimer: This newsletter is for informational purposes only, represents the opinions of Crosby Advisory Group and should not be taken as direct, individual investment advice. Investing involves risk including the potential loss of principal. Nate Crosby and Crosby Advisory Group have ownership interests in NMD Insurance and CAG Marketing.

Follow us on Social Media

Facebook: Crosby Advisory Facebook Instagram: Crosby Advisory Instagram