Treasure in Change, limit boosts, and a Turkey Trot

Precious Metal Collectors, Pay Attention to Your Change

Gold and silver prices are down for the year, but we would expect the prices to be suppressed a bit as interest rates continue to climb. Gold and silver are often thought of as hedge investments when things get rough for the economy or the stock market. However, gold and silver face resistance when interest rates climb. If an investor has $1,800 to invest and can now place that money in a Schwab money market mutual fund earning nearly 4%, owning a 1-ounce gold coin that does not pay interest may not be as attractive to many investors.

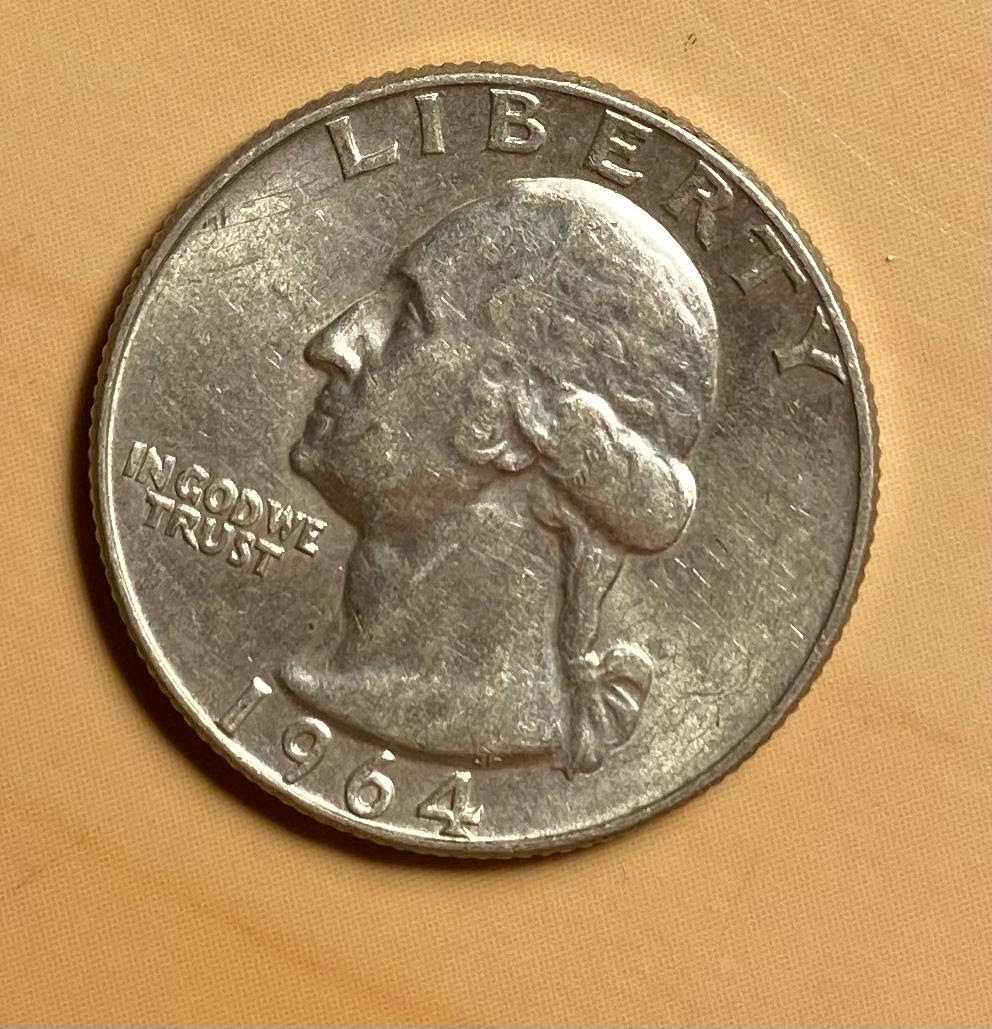

We are fans of acquiring investments when they are out of season, and here is a way to pick up some silver without having to place an order with your favorite precious metals exchange. Did you know that nickels, dimes, and quarters issued prior to 1965 are 90% silver? These coins are still in circulation today so think twice before putting a 1964 quarter in a vending machine. Right now, they are selling 1964 quarters on eBay ranging from $6 to $45, depending on the condition. Look for yourself!

For those interested in getting into coin collecting or just need a resource as you examine the jar of change on your dresser, check out PCGS CoinFact app. This is one that I personally use for my coin collection.

Retirement Savers Get a Boost in 2023

Contributions to retirement plans are increasing in 2023. IRA contributors will be able to contribute up to $6,500 in 2023, or $7,500 if they are over the age of 50. SIMPLE IRA contributors will be able to add up to $15,500 in 2023, or $18,500 if they are over the age of 50. 401k investors will be able to contribute up to $22,500 in 2023.

SEI Custodies Client Assets in Trust

The downfall Bahama-based crypto exchange FTX has raised concern with the safety of custodied assets. SEI Private Trust Company was Crosby Advisory’s first custodian. A big reason why we selected SEI was the way that they safeguard client assets. SEI holds client assets in Trust, outside of the company’s balance sheet. Holding assets in Trust is the safest way to custody client securities. SEI also does not make loans as most brokerage houses do and holds no debt on its balance sheet. Safety is often undervalued until it is needed. We feel highly confident knowing that SEI Private Trust Company is part of our product offering.

2022 Chardon Turkey Trot: I survived and beat Kringle

On Thanksgiving morning, I joined local runners in Chardon, Ohio for a 5K run. Portions of the entry fee went towards fighting human trafficking. Some contestants running the race dressed in full turkey consumes. Even Santa Claus made an appearance, toy sack and all (and he ran with it). I remember coming up the final hill into Chardon square where I was battling to stay ahead of a father pushing a double stroller and a boy that looked no older than 12. Did that scene humble me? For sure, I admit my best days as an athlete are behind me, but I still beat Santa.

Disclaimer: This newsletter represents the opinions of Crosby Advisory Group, LLC and is not designed to replace individual consultation. Investing involves risk including the potential loss of principal. Consider all risks and fees before investing. Crosby Advisory Group, LLC has ownership interest in CAG Marketing and NMD Insurance.