Tilts and Fun Predictions for 2022

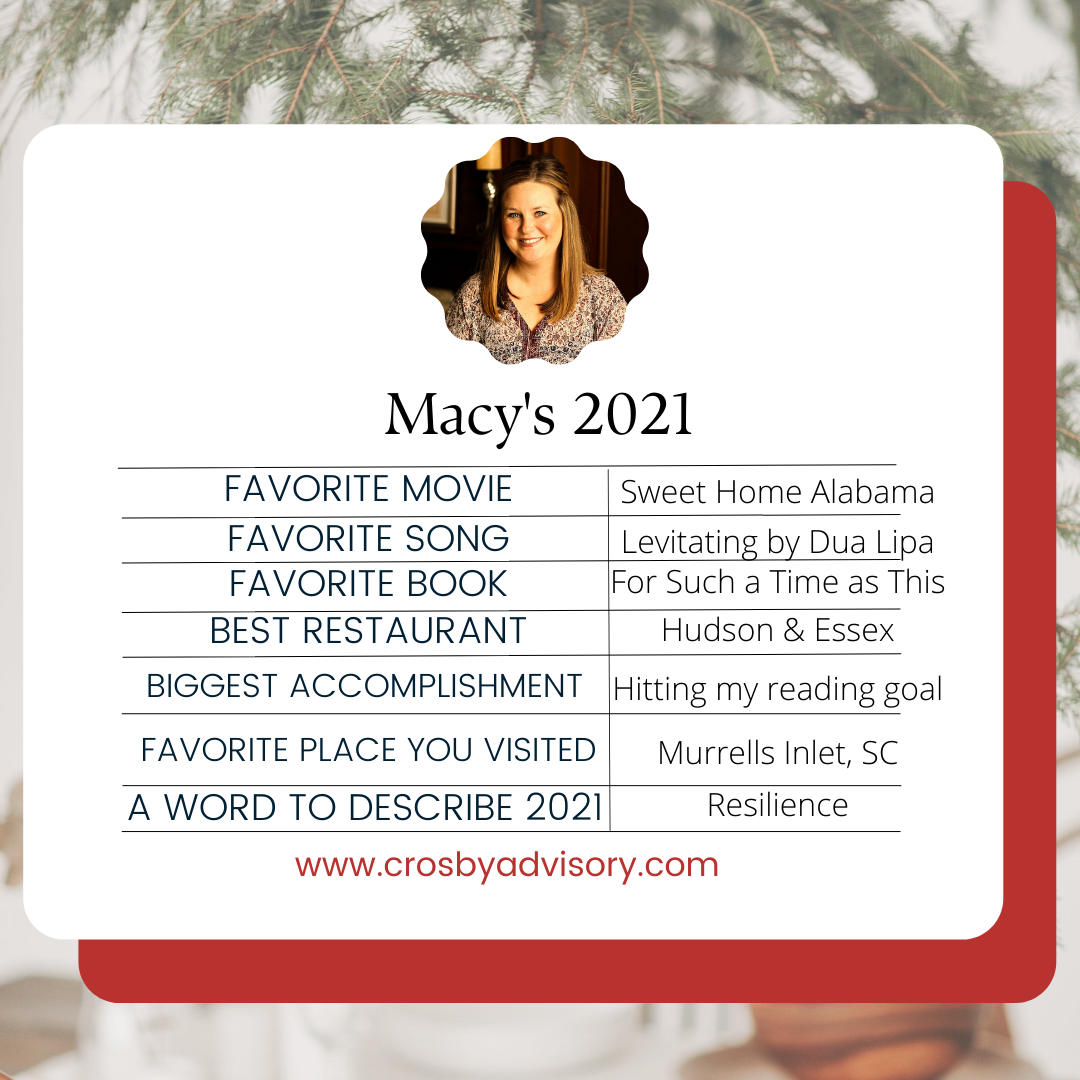

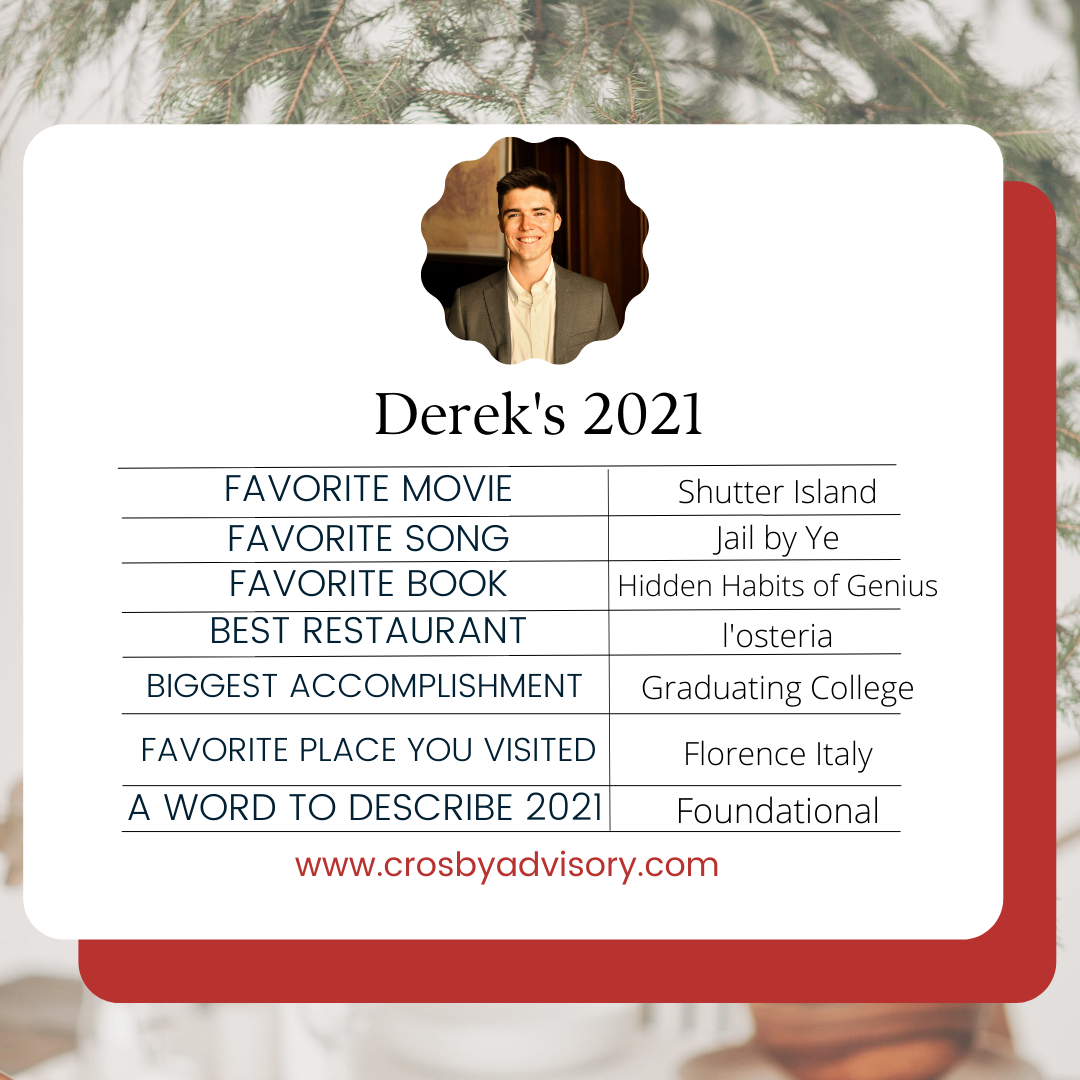

My rock-solid prediction for 2022: my wife, three children and I will attempt to stay up to see the ball drop. Not all of us will make it 😊. Derek put together a cool summary of each of our favorite experiences for 2021. Make sure you check it out below! I wish you and your family a wonderful New year. -Nate

Weekly Wisdom

“He accepts no concessions. As far as the thorn in his heart, he is careful not to quiet its pain, on the contrary, he awakens it.”

This is my favorite quote from the book, “The Myth of Sisyphus”. The masses will choose comfort. Those who rise above choose discomfort. As investors we read, expand, dream, dare, do, fail, do again, and ultimately succeed. We find meaning, not in the numbness of the status quo, but in the discomfort of pushing forward towards a better version of ourselves -because we can.

Tilting into the New Year

“The last will be first and the first, last.” -Dutch Proverb.

At the beginning of each year, we often add a tilt to all investment strategies that have a risk tolerance of moderate-high and above. What is a tilt? A tilt is when we add a small concentration to the portfolio in an investment or sector that appears to have a growth advantage going forward.

For example, after the March Covid induced stock market collapse of 2020, it appeared that the recovery was in full swing by early summer. Historically, when a recovery is underway, the financial sector (XLF) is one of the last sectors to recover. Therefore, we wanted to be in the financial sector while it was still down. We added XLF to the models which proved highly positive. In 2021 XLF returned 32% and was the second-best performing sector in 2021 behind the energy sector, which was the worst-performing sector in the prior year – which brings us to our standard tilt.

In the absence of an environmental factor to spur growth or a clear and present danger, we will simply add the worst performing sectors from the previous year to serve as our tilts. There are rare occasions when a sector is the worst-performing sector two years in a row. In fact, from a value standpoint, picking the beaten or lagging sector has historically proven to provide a high risk-adjusted return. Consider in 2016 the health care sector was the worst-performing sector at -2.7%. In 2018 it was the best performing sector at 6.5% when the overall market was negative. In 2020, the energy sector was the worst-performing sector at -33%. In 2021, the energy sector was the best performing sector, returning a whopping 45%.

Ray Dalio built the world’s largest hedge fund by putting the odds for competitive growth in the investor’s favor. This does not mean every year is positive, but we are highly confident in the long-term trend.

Making Predictions is *Probably* Stupid

-Derek Ballinger

The past few years are nothing if not an example of how much the world can change in such a short amount of time. All of the standard disclaimers apply, this is not a recommendation for anybody to buy or sell a stock based on these predictions and I make these predictions knowing that the majority will probably be wrong, but predictions are fun so that's why people do them.

These are a few predictions I have for 2022…

The Federal Reserve will in fact raise interest rates to around 1%

This is probably the safest prediction I will make because the narrative has completely shifted on inflation. The large macroeconomic experiment of shutting the economy down and raising the money supply by over 30% has consequences that should have been very easy to predict. We are seeing large consumer price inflation that is likely under-reporting inflation and is likely a lagging indicator of actual inflation. I think inflation is here to stay and it used to be controversial for the Federal Reserve to raise interest rates to slow down the economy, but now inflation has become such a problem that it will be much more controversial for them to sit on their hands and do nothing.

We will see LOTS of Volatility

Put on your seatbelts if you own stocks, if stocks go much higher than their current levels it is pricing in a few years of a robust high growth period for large companies. A rise in interest rates will shift that narrative and the forecast for stocks will not be so rosy so we will likely see a decrease in valuation for a lot of stocks trading at high multiples. We also will see investors look for stocks at a discount so expect value stocks to outperform the growth stocks. 2021 was the first year in a while where the S&P outperformed the NASDAQ. We could see this again in 2022.

We also have a Federal Reserve that really cares about the stock market. This is not part of the Federal Reserve's mandate but they do in fact care about the stock market so if the rising interest rates negatively impact stocks so much so that it causes a correction or bear market I predict the FED reverses course and begins buying assets and dropping rates.

Semiconductors Reign Supreme

Semiconductors are becoming so integral to everything in our economy, coupled with the fact that the global supply chain has not sure up many of the issues in 2021, semiconductor companies will continue to grow at a rapid clip and yes the valuations are much higher than they have been historically for companies like NVIDIA and AMD, but investors will pay up for their insane revenue and earnings growth and NVDA, AMD, QCOM, MU, and others will outperform in 2022.

China Stocks are Deep Value

Alibaba is trading at 1.98x next year's earnings. I think that's a huge mismatch between the underlying stock and the price it's trading for. JD.com a Chinese internet retailer is trading .82x sales and 5x next year's earnings. A lot of these stocks are down significantly YTD and will come back in 2022

Small Caps Outperform in 2022

Small-Cap stocks are stocks with a market cap of 300M to 2B. When somebody says “Outperform” they typically mean to grow more than the S&P 500 which is a large-cap index (Larger than 10B). Large Cap stocks are trading at a high valuation and when the gap between the large-cap valuations and small-cap valuations gets increasingly large you eventually see small caps outperform large-cap stocks for a period of time. We are adding an Equal Weight Small-Cap ETF (EWSC) to some of our strategies to benefit from that discrepancy.

My Winners for 2022

MELI DIS MA AMD AMZN QCOM GOOG SBUX MU PYPL SHOP SQ CCI BABA OSTK FB