Social Security and its Uncertainty

Social Security and its Uncertainty

Max Vesper | February 3rd, 2025

Social Security and its value for the retirement funding of the upcoming generations has recently emerged as a rising concern.

How it Works

Originally signed into law by the President in 1935, Social Security was put in place to support the elderly after poverty and joblessness issues created by the Great Depression. By taking a portion of income, Social Security guarantees future retirement funding, based on the 35 highest earnings years of the beneficiary. To make this possible, 6.2% of your income is put into a Trust Fund, and earns around 2.44% interest from bonds and some Certificates of indebtedness.

So, what’s the problem?

A research study from Cerulli Associates conducted on active 401(k) participants found that over half of retirees (56%) say that Social Security is their primary source of income, while 30% of Gen X and only 6% of millennials say that they expect Social Security to be their primary funding for retirement.

This speculation and uncertainty comes from the depletion of the Social Security Trust Fund, which is expected to be fully depleted by 2034 according to the 2024 OASDI Trustees Report.

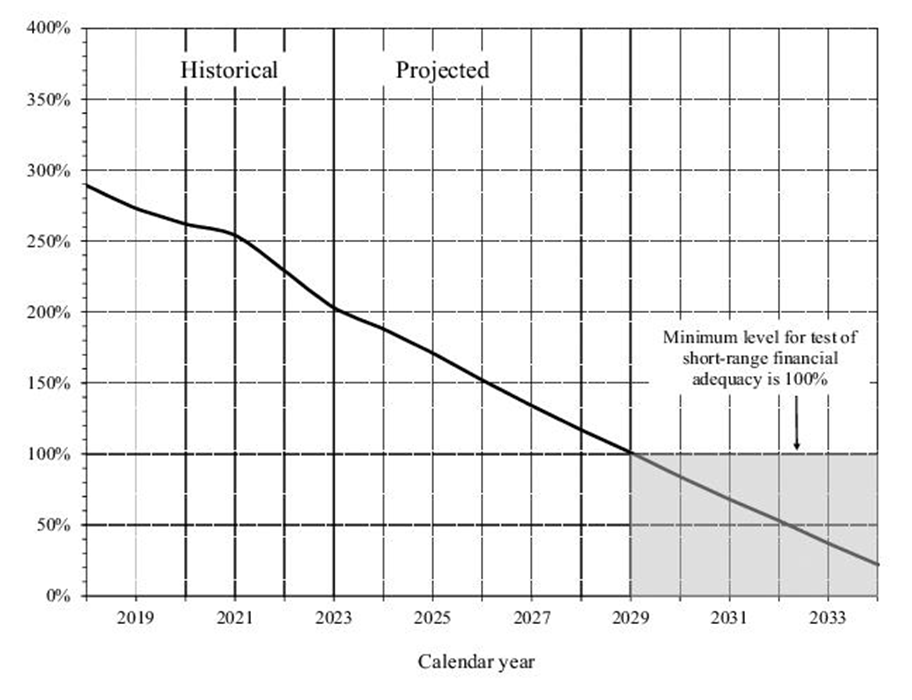

Figure 1: OASDI Trust Fund Ratio per 2024 OASDI Trustees Report

Compared to historical levels sitting around 250%-300% as shown in the chart above, lower Trust Fund Levels are projected to cross below 100% by 2029. These lower projections are a result of the surplus of a certain generation heading into retirement: baby boomers.

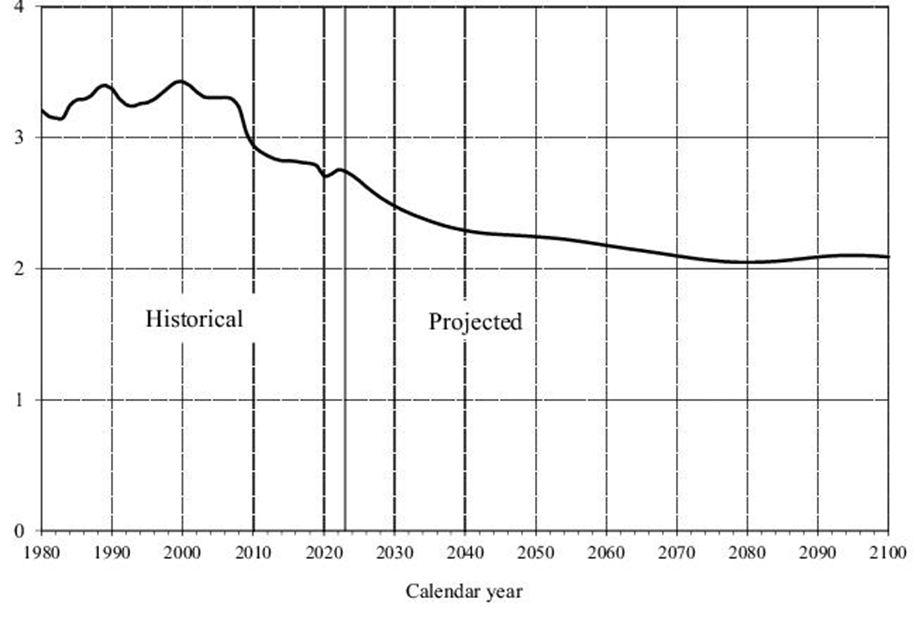

Figure 2: Number of Covered Workers per OASDI Beneficiary per 2024 OASDI Trustees Report

As the baby boomers retire, the ratio between supporting workers and Social Security and Disability beneficiaries shrinks. Traditionally, the number of workers per Social Security beneficiary was over three, but this ratio is expected to dip to almost two, meaning a Social Security beneficiary will be supported by two workers rather than three. In short, less workers and more retirees = less Social Security funding.

How can this be fixed?

Several different options have been suggested, as Rob Burgess reports in his article, “How financial advisors want a Social Security shortfall handled.” When asking 213 wealth professionals about what should be done to maintain Social Security’s funds:

- 34% said to raise taxes on high-earning workers

- 25% said to increase full retirement age

- 17% said to privatize Social Security

- 10% said to raise taxes on all workers

Without the implementation of one of these actions or something alike, we will likely see a reduction of around 20% of Social Security benefits, per the Social Security Administration. While Social Security will still be an adequate source of funding for retirement for years to come, it is important to look into alternative sources of income to ensure a healthy retirement.

Conclusion

Social Security is a key part of retirement strategies today. If you're looking to assess your current approach or hoping to better understand your retirement options, give our office a call!

Crosby Advisory Group, LLC is a registered investment advisor providing financial planning, insurance and business growth strategies. This blog is for information purposes and does not represent individual investment advice. Not all investments are suitable for all people. You should carefully consider all risks and fees before making an investment.