Savers, your favorite tools are enhancing

Risk-off assets rising

I snapped this picture as I exited our office on Friday. I’m not full of hot air in saying rising interest rates are not all bad, especially for savers. Our Schwab money market now pays 3.30% as of 11/6/2022 and is designed for zero volatility with no minimum balance or investment period. Many fixed annuity products offer guaranteed rates above 5%. Structured notes can be purchased with contractual rates of 8% and higher. Displaying patience is much easier when you are getting paid competitively to do so.

Money market mutual funds, annuities, and structured notes are not FDIC-insured.

Gaining Market Share Efficiently

Carly Snyder of CAG Marketing photographed (far left) helping a client identify global objectives so that she can build them an effective marketing plan. Businesses with less than 50 employees often do not have their own marketing department. These businesses can obtain Fortune 500 marketing talent without having to pay for a full-time marketing professional. Economic downturns are potentially great opportunities to gain market share through underserved prospects. Contact Carly for a discussion on how your business can gain a strategic advantage. Email csnyder@crosbyadvisory.com or visit marketingcag.com.

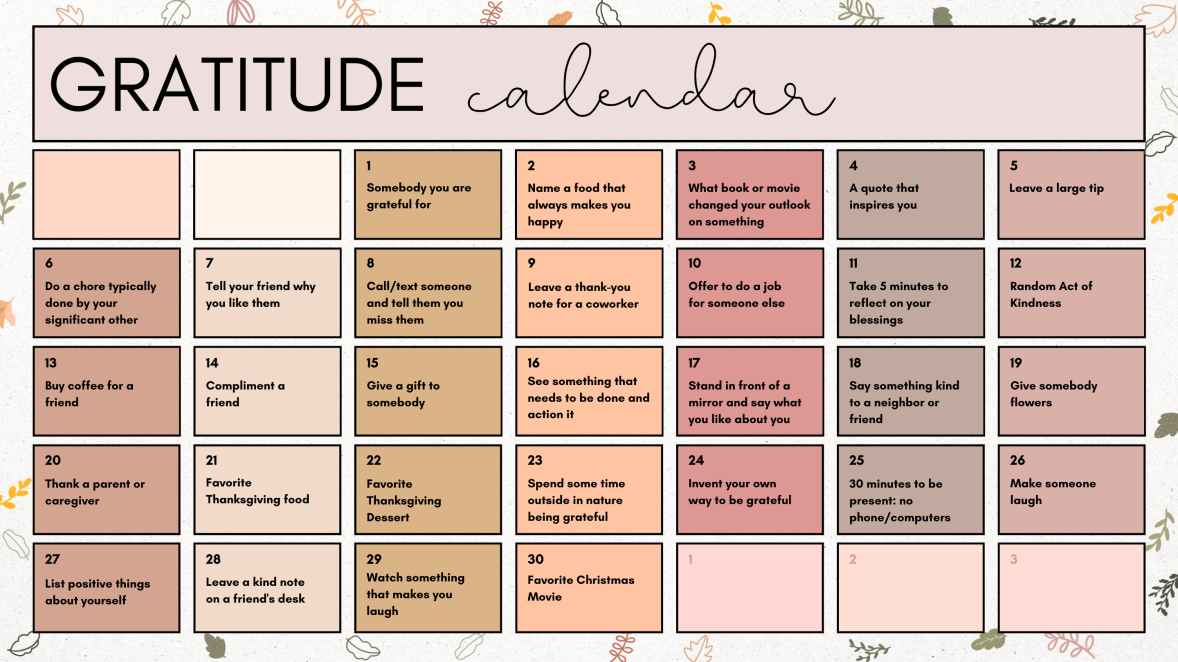

Month of Gratitude

Join us on Instagram and/or Facebook as we celebrate a month of gratitude in November. We set a goal to perform at least one act of gratitude per day. We look forward to seeing you there!

Fed pivots from hawkish to a larger bird of prey

The Federal Reserve raised interest rates again last week by 0.75%. There is a story being told by the Federal Reserve but it isn’t the story the stock market is hearing, or at least wants to hear. Since the first interest rate increase in March, many growth stock investors have been waiting for the Federal Reserve to pivot from hawkish to dovish by pausing and ultimately reducing interest rates. There is a belief that the Federal Reserve will see the decline in the stock market and call off the dogs, by slowing interest rate increases or halting them altogether. Yet Federal Reserve Chairman Jerome Powell has been steadfast and consistent in his message that they will continue to raise interest rates until demand for products, and thus inflation declines to an acceptable level. Growth stock investors shouldn’t hold their breath. Peak inflation was in June at 9.1% and since has only reduced to 8.1% in September. October’s inflation rate, as measured by the consumer price index will be released November 10th and has the potential to remain elevated considering how much energy plays into the CPI number. With the approaching mid-term elections, additional oil reserves were released in an attempt to bring down gas prices, but they seem to have had little effect at the pump. With the U.S. labor market remaining strong, there is no reason for the Federal Reserve to deviate from its stated mission of raising interest rates until it can reach a restrictive rate at which consumption declines. This unfortunately means a higher unemployment rate and higher prices for borrowers. Investors disgusted by the loss they incurred on their growth stocks may want to stop waiting for a Federal Reserve pivot and instead look at what is now attractive. Hang onto those growth stocks. There will be a time when growth stocks will soar again, but not until the data supports a more accommodative interest rate environment. That likely won’t happen until the inflation is tamed.

Artwork courtesy of Susie C.

Disclaimer: This newsletter represents the opinions of Crosby Advisory Group, LLC and is not designed to replace individual consultation. Investing involves risk including the potential loss of principal. Consider all risks and fees before investing. Crosby Advisory Group, LLC has ownership interest in CAG Marketing and NMD Insurance.