Paying for college, becoming a millionaire and insurance downgrade

Which assets do you spend first for higher education?

Savings for higher education is challenging to say the least. While much of the focus is often given to the type of savings vehicle to use to save for a child, equal attention should also be given to the order in which those assets are spent. For example, grandparents can be a great source of funding. If it makes sense with their estate plan, 529 plans allow grandparents to “front load” the plan by putting in as much as 5x the annual gift tax exclusion (per beneficiary). This means a grandmother and grandfather could lump sum $150,000 into their grandchild’s 529 plan, allowing the grandparents to remove the money from their estate and fund their grandchild’s education. Keep in mind that distributions from third-party (grandparent-owned) 529 plans count as income for the student. Assets in the student’s name will count more against financial aid than assets in the parent’s name. When applying for financial aid, the FAFSA form will require the prior, prior year income. No, that's not a grammatical error. If the student is now submitting a FAFSA form for the August 2024 semester, the FAFSA form will require tax returns for the student (if applicable) and parents from 2022. Knowing that, it might not be a bad idea to wait until the student is enrolling for their Junior year before we begin taking distributions from grandma and grandpa’s 529 plan so that income does not count against the student for receiving financial aid during their freshman and sophomore year. If the student has excess 529 assets, they can now roll those assets into a Roth IRA for the student's retirement.

The Forgotten Asset

As college years approach, and you look for options to efficiently pay for college, don’t forget your cash value life insurance policy. Here are five benefits your policy provides:

- Cash in the life insurance policy is not counted as an asset for the child or parent

- The death benefit can ensure higher education can be afforded even in the event of your death.

- Distributions up to the policy’s cost basis are tax-free

- Excess distributions over the cost basis can be taken as a low interest rate loan that has no bearing on your credit

- Distributions do not count as income for the student

As a parent, saving for higher education can be a daunting task. Take a deep breath and remember, you can get assistance paying for college, but no one is going to give you assistance in funding your retirement.

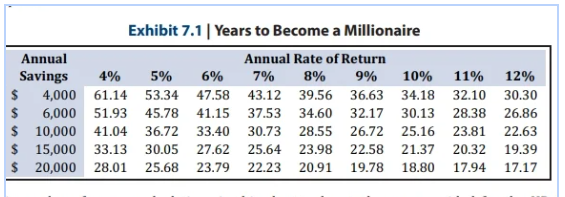

Becoming a Millionaire

The millionaire status is still very much worthy of celebration. According to a recent study, there are about 24.5 millionaires living in the United States today. Most millionaires are self-made, meaning they sold a successful business, real estate portfolio, accumulated and grew assets over time in investment markets, or a combination of enterprises. If your path is through investments, there are three main ingredients to wealth creation: 1. the amount you save, 2. the time you let assets grow, and 3. the return you get on investment. We have the greatest control over time and funding. How do professional investors do it?

In a recent video we discussed the benefits of creating an investment engagement letter with the help of your advisor to:

- Clearly define your goals

- List the type of investments that will help you accomplish your goal

- Define acceptable volatility

- Define how you will track progress to make sure you remain in course.

We discussed reaching the $1,000,000 mark, among other things in our most recent podcast. You can listen to it here.

Outlook Downgrade for Major Insurance Company

It has been a challenging three years for property & casualty (home, auto, business) insurance companies. Claims are historically high because many consumers are already stretched in credit card debt and inflation pressures. The cost of materials and repairs have exceeded what many insurance companies planned for in their premiums. This is why consumers are seeing substantial renewal increases. A.M. Best is a rating organization that monitors the financial health of all insurance companies. Recently A.M. Best issued an outlook downgrade for State Farm Mutual due to the high levels of claims it has incurred on its personal auto exposures. We are in what the insurance industry calls a “hard market.” In hard markets premiums rise and the appetite of what insurance companies are willing to insure is reduced. As a consumer, if you find increases are more than you can afford to pay, your best option may be the open market. Have your agents quote other insurance companies or consider reviewing your deductibles, which may help lower costs. In the opinion of Crosby Advisory Group, your deductibles should be coordinated with your emergency fund. If you have 3-6 months of non-discretionary assets in an emergency fund, a $250 deductible doesn’t make a lot of sense. Insurance should protect you from the financially threatening loss.

Disclaimer: Crosby Advisory Group, LLC provides financial planning, business growth strategies and insurance services. This newsletter is for informational purposes and should not be taken is personalized investment advice. Investing involves loss including the potential loss of principal. Consider all risks and fees before investing.