New year's hacks, meet Macy Vogel and stock spotlight

Team Member Spotlight: Macy Vogel

Macy Vogel is the Vice President, and part owner of Crosby Advisory Group, LLC. Macy is a 2013 graduate of The Ohio State University and was only 22 years old when she joined Crosby Advisory Group. In late 2013, I was in the process of conducting interviews for our Ashland office. I was ready to make a selection when a friend of mine highly suggested I interview Macy before making anyone else an offer. I knew within the first few minutes of the interview Macy was going to play an important role in our success. Macy has witnessed our best and many of our most challenging days. There is however a day that stands out to me as the moment I knew she was the definition of a team player. I had gotten to the office at 5:30 AM that morning to prepare for a scheduled audit by the Ohio Department of Commerce. Macy of course got there early to assist. There was a strange flapping noise that was coming from our lobby. I thought perhaps it was the auditor, showing up early to surprise us with coffee and donuts. As we peered out into the lobby, we were indeed surprised, but not by a person in a suit; staring back at us was the largest bird I had ever seen. When Macy tells the story she claims it was a typical blackbird, but it appeared to be genetically mutated; a crow with biceps is the best way I can describe it. We tried opening the front door, we turned off the lights, we even yelled “shoo” multiple times, but it simply would not leave. Then suddenly it leaped from its perch and started bearing down on us. I knew I didn’t have to beat the beast, I only needed to out-run Macy, so I sprinted by her with the speed of defensive back. Now before you judge me as a gentleman and human being, remember, someone needed to be present for the audit. Thankfully she survived the attack, and she called the bravest man I know for help, her dad, Nick Claypool. Nick served in the U.S. Navy, and what I witnessed that day was beyond heroism. The man chased the bird into a room and grabbed it out of the air like a cat with his jacket. He casually walked it outside to set it free just as the auditor was parking his car outside, totally oblivious to the mayhem Macy helped to end.

Over the years Macy has helped the business successfully navigate many changes. She continues to be the embodiment of reliability. Today, along with serving as the company’s Vice President, she oversees all client services and manages our Ashland office. Macy lives outside of Ashland, Ohio with her husband and two children. Macy is an avid reader and enjoys spending time with family and friends, gardening, and being outdoors.

Why stocks eventually rise after a prolonged down market

Prolonged down markets, or bear markets, eventually cause stocks to fall below their fair value. This is what helps lead to the eventual turn around. Stocks can trade above and below their fair value for extended periods of time, but ultimately, they resort back to their mean.

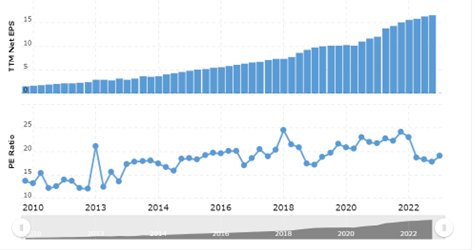

The Home Depot Price to Earnings

Take a look at the Home Depot’s stock above. Home Depot’s earnings per share is at an all-time high. Its price, however, is not. One ratio that investors love to calculate is P/E or Price to Earnings ratio. We simply divide the price of the company's stock per share by the earnings per share. P/E can give us a reference point as to how expensive a stock is compared to its revenue. What we see now is the Home Depot is price below its historic valuation over the past 15 quarters.

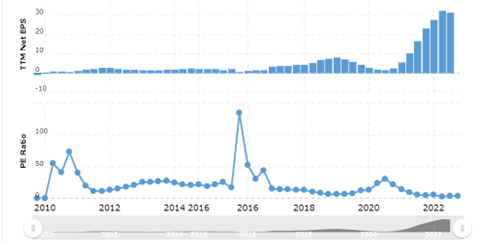

Nucor Price to Earnings

If we look at steel maker Nucor’s stock we see a similar story. Nucor’s earnings per share is near an all-time high, yet its price to earnings ratio is near historic lows.

It is around this time, 12 months into a bear market where you start seeing novice investors shutting off their auto funding into their accounts as they grow tired of seeing falling stock prices. Yet, history has proven bear markets are the best time to fund accounts if the investor has time to be patient. As Warren Buffett would say, we want to buy a dollar for 50 cents.

Note: Stocks can remain priced below their fair value for an extended time. These are just examples of stocks priced below their recent historic value; not direct investment advice.

Psychology’s Hack for New Year's Resolutions

We find ourselves at that familiar spot again; a new year lay before us like a white canvas. Yes, I realize the New Year is just a temporary location in space relative to our sun, but it is a fitting time that we pause to plan our next charge at potential, if nothing more than because we typically have a restful day to do so. I too spend some time at the end of the year thinking what I want to accomplish over the next 12 months. Here is a New Year’s resolution hack to consider as you lay the groundwork for the next 12 months of success.

Even a cursory study in human psychology will inevitably bring you to the study of the ego. The ego is the part of our conscious mind that identifies as “I”. “I can’t resist chocolate. I am not good at speaking in public. I have a hard time-saving money. I’m a little bit overweight. I’m a smoker. I’m not what I used to be.” Labeling and past identification are very important to the ego. The number one goal of the human mind is to keep us alive; it is constantly scanning our environment for risks. The ego plays a large role in preservation because it tethers us to our past. We were alive in our past; thus, basic reasoning suggests doing the same things in the future will lead to the same result. “Changing” through resolutions is hard because our ego really doesn’t want us to change. It’s comfortable with the known and the labels of our past. “That’s just not me, I wasn’t built to do that.”

Yet at any moment we have the power to sever the past and reinvest ourselves. What is more miraculous is that change doesn’t have to take years, it can occur the very moment we decide that change is our new reality. “I have the power to resist chocolate. I am getting better at public speaking every day. I am better at saving money today than I was yesterday. I’ll be even better tomorrow. I am in the process of obtaining my ideal weight. I’m a nonsmoker. I’m acquiring skills that make me better than I was last year.” The ego will always be there, but we must control its operating code.

The easiest way to do that is to be an observer of the voice inside your head. Realize, that voice is not you, it's your ego. Listen to the voice, but don’t follow it blindly. Override it when needed, and chances are you’ll have to override it a lot. “I deserve that piece of chocolate cake. After a long day, I need an extra drink. I’m not going to make that suggestion to my boss, she might think it's dumb.” A longtime friend and former teacher of mine dropped off a book to me in December by Benedict Carey, titled, “How we Learn”. It was fitting that he let me borrow that book at the end of the year, as I am assessing who I was and what I intend to become. He told me the greatest frontier is not space, it's our mind. I agree with him. Understand it, protect it, but more importantly, master it, and even New Year’s resolutions are yours for the taking.

Is earthquake insurance worth it in Ohio?

Earthquake insurance can be added to a home insurance policy and usually comes with a deductible that is at least 5% of your home’s insurance value. If you live in Ohio, is it worth it?

According to data from the United States Geological Survey (USGS), the average annual probability of an earthquake of a magnitude of 3.0 or higher occurring in Ohio is about 1%. It’s important to note that the probability of an earthquake occurring in a specific location can vary depending on many factors, including the proximity to fault lines. While earthquakes are not common in Ohio, the insurance rates to insure against earthquakes also reflect the rarity of claims by being very inexpensive to purchase.

Crosby Advisory Group, LLC is a registered investment advisor in OH, FL and TX. Investing involves risk including loss of principal. Not all investments are suitable or all people. This newsletter is for informational purposes and does not represent direct investment advice without a consultation. Crosby Advisory Group, LLC provides marketing and business growth services under the name CAG Marketing. Nate Crosby has ownership interest in NMD Insurance.