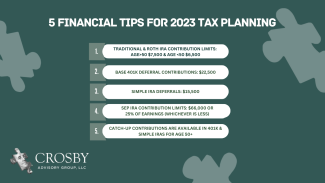

2023 Annual Limits for Financial Planning

2023 Financial Planning Annual Limits

Many of the topics we cover in our podcast, Health & Wealth videos and our newsletter come from our clients and this one is no exception! Each year the IRS provides updated guidance for all types of qualified retirement plans and IRAs. The annual contribution limits will either remain unchanged or may rise in some cases. Many of you have inquired about the 2023 information so we attached a PDF quick reference guide for your convenience.

Highlights for this year’s credits and rates

- Traditional and Roth IRA contribution limits remain at $6,500 for investors under 50 and $7,500 for investors over 50

- Base 401k deferral contributions have been increased to $22,500

- SIMPLE IRA deferrals have increased to $15,500

- SEP IRA contribution limits have been increased to $66,000 or 25% of earnings, whichever is less (self-employed? Consider a SEP IRA to control your tax bracket)

- Catch-up contributions are available in 401ks and SIMPLE IRAs for those over 50 Download your printable copy of the 2023 Financial Planning Annual Limits PDF

Pro tip: save a copy to your computer desktop or print one off for your desk. It's also great to have in your back pocket for your next dinner party or kid's soccer game so you can wow the crowd with your knowledge on tax credits and rates!

As always, if you have any questions about how this impacts your investment portfolio, please don't hesitate to contact us.